IRS Form 8233. Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual

Form 8233 is a document used to request exemption from withholding on compensation for independent or dependent personal services provided by a nonresident alien individual. The main purpose of this form is to prevent double taxation and reduce the burden on nonresident aliens who earn income in the United States.

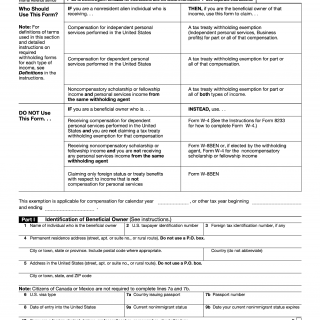

The form consists of several parts, including personal information about the nonresident alien individual, details about the type of compensation being earned, and information about any dependent personal services being provided. Important fields include the taxpayer identification number (TIN) or social security number (SSN), the name and address of the employer, and the reason for the exemption.

Parties involved in the process include the nonresident alien individual providing the personal services, their employer, and the Internal Revenue Service (IRS). It is important to consider applicable tax treaties between the United States and the country of the nonresident alien individual when completing the form.

When writing the form, data required includes personal information about the nonresident alien individual, details about the compensation being earned, and any relevant tax treaty provisions. Supporting documents that may need to be attached include proof of residency and documentation supporting any claims of tax treaty benefits.

Examples of application include instances where a nonresident alien individual is performing services in the United States for a limited period and wants to avoid having taxes withheld from their compensation. This can apply to individuals such as actors, athletes, and speakers who come to the United States for specific events or performances.

Strengths of Form 8233 include its ability to reduce the burden of double taxation on nonresident alien individuals and make it easier for them to earn income in the United States. However, weaknesses may include the complexity of the form and the need to accurately assess tax treaty provisions.

Alternative forms or analogues to Form 8233 may include Forms W-8BEN and W-4. The main differences between these forms are the types of income they apply to and the parties involved in the process.

Submitting Form 8233 typically involves providing it to the employer who will then submit it to the IRS. The form is stored by both the employer and the IRS for record-keeping purposes.

Overall, Form 8233 can play an important role in facilitating international commerce and reducing the burden of double taxation on nonresident alien individuals.