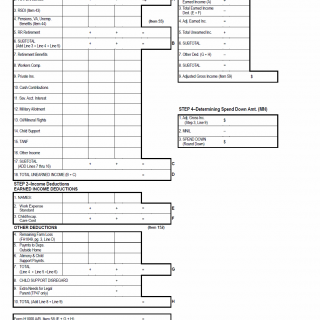

TX HHS Form H1119. Medical Programs Income Worksheet

The TX HHS Form H1119, Medical Programs Income Worksheet, helps determine an individual's eligibility for medical programs by gathering information on their income and expenses. This form is typically filled out by individuals applying for Medicaid or other government-funded healthcare programs in Texas.

The form consists of several steps, including earned and unearned income calculations, deductions, and a spend-down amount determination. Key features include the recognition of needs test or fixed period income/needs test (FPIL/MNIL), which helps determine an individual's eligibility for medical assistance. The form also requires information on total countable earnings, retirement benefits, and other sources of income.

By completing this form, individuals can ensure they have accurately reported their income and expenses to determine their eligibility for medical programs. This process helps streamline the application process and ensures that only those who truly need assistance receive it. Key points to keep in mind include:

- The form is used to determine eligibility for Medicaid and other government-funded healthcare programs in Texas.

- The recognition of needs test or FPIL/MNIL test helps determine an individual's eligibility for medical assistance.

- The form requires information on total countable earnings, retirement benefits, and other sources of income.