DA Form 2446. Request for Orders

DA Form 2446, also known as the Request for Orders form, is a document used in the United States Army to request official orders for various purposes, such as training, deployment, or reassignment.

DA Form 7765. Army Disaster Personnel Accountability and Assessment System, Command Officer Representative Access Request

DA Form 7765 is a document that serves as an access request for Command Officer Representatives to the Army Disaster Personnel Accountability and Assessment System (ADPAAS).

Form LIC 501. CCL/Personnel Record

The LIC 501 form is a Personnel Record used by the California Social Services agency. Its main purpose is to collect and maintain personnel data for licensed community care facilities in the state of California.

Form LIC 401. Monthly Operating Statement

LIC 401 is a monthly operating statement form issued by the California Social Services department for Family Child Care Homes in California.

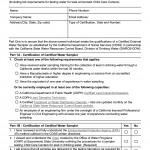

Form LIC 279A. License Application And Instructions For Family Child Care Homes

LIC 279A is a license application form and set of instructions issued by the California Social Services department for individuals or groups who wish to establish a Family Child Care Home in California.

DA Form 2397. Technical Report of US Army Aircraft Accident Part I - Statement of Reviewing Officials

DA Form 2397, also known as the Technical Report of US Army Aircraft Accident Part I - Statement of Reviewing Officials, is a form used by the United States Army to document and investigate aircraft accidents.

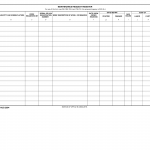

DA Form 2405. Maintenance Request Register

The DA Form 2405 is a document used by the United States Army to request maintenance for equipment that requires repair or replacement. The main purpose of this form is to facilitate the maintenance and upkeep of military equipment, ensuring that it remains in working order and ready for use.

Form LIC 9275. External Water Sampler Self-Certification Form

The LIC 9275 form is an external water sampler self-certification form used by the California Social Services agency. The main purpose of this form is to certify that a water sample has been collected in compliance with state regulations and to provide documentation of the sampling process.

Form LIC 621. Client/Resident Personal Property And Valuables

LIC 621 is a form used in the state of California by social service agencies to document and protect the personal property and valuables of clients or residents who are receiving care or services.

Form LIC 9283. Infection Control Plan - Adult Day Programs

The LIC 9283 form is a crucial document required by California Social Services for Adult Day Programs. The main purpose of this form is to provide an Infection Control Plan that outlines the steps and measures taken by the program to prevent and control infectious diseases.