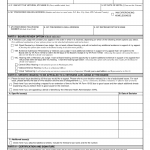

VA Form 10182. Decision Review Request: Board Appeal (Notice of Disagreement)

Form 10182 is a document used in the context of appealing decisions made by the Department of Veterans Affairs (VA) in the United States.

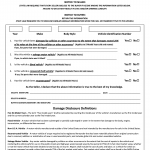

VA Form 21P-534. Application for Dependency and Indemnity Compensation, Survivors Pension and Accrued Benefits by a Surviving Spouse or Child (Including Death Compensation if Applicable)

The VA Form 21P-534 Application for Dependency and Indemnity Compensation, Survivors Pension and Accrued Benefits by a Surviving Spouse or Child (Including Death Compensation if Applicable) is a form used by the Department of Veterans Affairs to apply for benefits by surviving spouses or children

Form MVR-181. Damage Disclosure Statement

The MVR-181 Damage Disclosure Statement is a form used by the North Carolina Department of Motor Vehicles to disclose any damage or repairs made to a vehicle when transferring ownership.

Form 1290. Application for Australian citizenship - Other situations

Form 1290 is an application form for individuals seeking Australian citizenship through other situations. The purpose of the form is to provide information about the applicant's personal background, residence, and eligibility criteria required for acquiring Australian citizenship.

FlyLady's Weekly Checklist

FlyLady's Weekly Checklist is a useful tool designed for individuals who want to maintain a clean and organized home. This checklist serves as a guide for completing weekly cleaning tasks to keep your living space tidy and comfortable.

Form DMV 130 MCP. Motor Carrier Permit Application for Certificate of Self Insurance

The DMV 130 MCP form is an application for a Motor Carrier Permit (MCP) Certificate of Self Insurance for commercial vehicles in California.

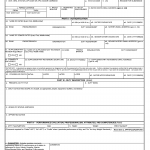

DA Form 2166-9-3. NCO Evaluation Report (CSM/SGM)

The DA Form 2166-9-3 is an NCO Evaluation Report specifically designed for Command Sergeant Major (CSM) and Sergeant Major (SGM) ranks. The form serves as a record of the Non-Commissioned Officer's (NCO) performance and potential in their current duty position.

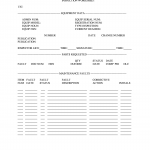

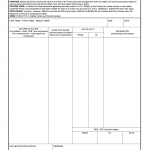

DA Form 5988-E. Equipment Maintenance and Inspection Worksheet (EGA)

The DA Form 5988-E, also known as the Equipment Maintenance and Inspection Worksheet (EGA), is a document used by the United States Army to record maintenance and inspection activities for military equipment.

AF Form 4422. Sex Offender Disclosure and Acknowledgement

The AF Form 4422 is a document used by the United States Air Force to disclose and acknowledge information about a service member's status as a sex offender.

AF Form 1613. Statement of Service

The AF Form 1613, also known as the Statement of Service form, is a document used by the United States Air Force to verify a member's service and employment history.