Form DR 0106K. Partnership Instructions for Colorado K-1

The DR 0106K form is an important document used by partnerships in the state of Colorado to report income, deductions, and credits of each partner. The main purpose of this form is to allocate partnership income and expenses accurately for tax purposes.

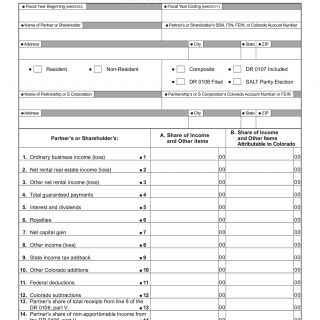

The DR 0106K form consists of several parts, including identifying information, income and deductions, and partner information. Some important fields that need to be filled out include the partnership's legal name, federal employer identification number, and the names and addresses of all partners. It is essential to provide accurate details such as profit/loss allocation percentage, capital account balance, and self-employment earnings of each partner.

Partnerships in Colorado are required to file this form annually. When filling out the form, data such as partnership revenue and expenses, each partner's share of profits or losses, and relevant tax credits are required. Additionally, partnerships may need to attach additional schedules or forms such as Schedule K-1 (Form 1065), which reports each partner's share of income, deductions, and credits.

One strength of the DR 0106K form is that it provides a clear and comprehensive way to report partnership income and expenses. However, some weaknesses may include the complexity of the form and the potential for errors if not completed accurately.

An example of how this form might be used is by a small business partnership in Colorado. They would use the DR 0106K form to report their income and expenses and allocate profits and losses among partners.

Alternative forms or analogues that may be used instead of the DR 0106K form include Form 1065, which is used to report partnership income to the IRS. The primary difference between the two forms is that DR 0106K is specific to Colorado state tax reporting, while Form 1065 is a federal form.

Filing the DR 0106K form accurately and on time can have a significant impact on the future of the partnership. It ensures that the partnership is compliant with Colorado state tax regulations and avoids any potential penalties or fines.

Partnerships in Colorado can submit the DR 0106K form electronically using the state's Revenue Online system. The form is stored electronically and can be accessed by the partnership as needed. It is important to note that failure to file the form by the deadline could result in penalties and interest charges. Therefore, it is crucial to file the form accurately and on time.