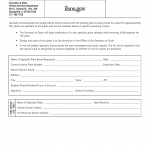

Form VSD 978. Specialty License Plate Request - Illinois

Form VSD 978 - Specialty License Plate Request serves as a request form for individuals to apply for specialty license plates that support various causes, organizations, or interests. These plates often have unique designs and help raise funds for specific initiatives.

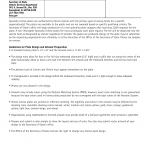

Form VSD 815. Specialty Guidelines - Illinois

Form VSD 815 - Specialty Guidelines - serves as guidelines for specialty license plates. This form is used by individuals who want to apply for specialty license plates to understand the available options, requirements, and guidelines for each type of specialty plate.

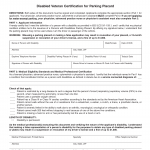

Form VSD 800. Disabled Veteran Certification for VA Plates - Illinois

Form VSD 800 - Disabled Veteran Certification for VA Plates - serves as a certification for disabled veterans applying for special license plates issued by the Illinois Secretary of State Vehicle Services Department.

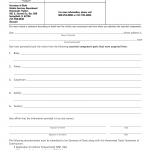

Form VSD 799. Customer Feedback - Illinois

Form VSD 799 - Customer Feedback - serves as a feedback form for customers to provide feedback about their experience with the Illinois Secretary of State Vehicle Services Department.

Form VSD 797. Homemade Trailer Statement of Construction - Illinois

Form VSD 797 - Homemade Trailer Statement of Construction - serves as a statement of construction for homemade trailers. This form is used by individuals who have constructed a homemade trailer and need to provide information about its construction for registration purposes.

Form VSD 796. Affirmation for Low-Speed Vehicle - Illinois

Form VSD 796 - Affirmation for Low-Speed Vehicle - serves as an affirmation for low-speed vehicles. This form is used by individuals affirming that their vehicle meets the criteria for being considered a low-speed vehicle according to Illinois regulations.

Form VSD 795. Driver Education Replacement Affirmation - Illinois

Form VSD 795 - Driver Education Replacement Affirmation - serves as an affirmation for the replacement of driver education materials. This form is used by educational institutions and organizations offering driver education programs to affirm the need for replacement materials.

Form VSD 794. Driver Education Request/Renewal Form - Illinois

Form VSD 794 - Driver Education Request/Renewal Form - serves as a request or renewal form for driver education programs. This form is used by schools and organizations offering driver education programs to request initial approval or renew their approval to provide driver education.

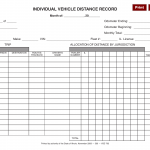

Form VSD 793. Individual Vehicle Distance Record - Illinois

Form VSD 793 - Individual Vehicle Distance Record - serves as a record of individual vehicle distances. This form is used by individuals or businesses to record and report the distances traveled by individual vehicles, often for purposes related to commercial activities or taxation.

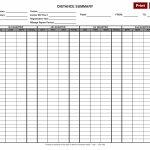

Form VSD 792. Distance Summary - Illinois

Form VSD 792 - Distance Summary - serves as a summary of distance records. This form is used by individuals or businesses to provide a summary of the distances traveled by their vehicles, often for purposes related to commercial activities or taxation.