Form TS 219. Fuel Tax Refund Application - Exports - Virginia

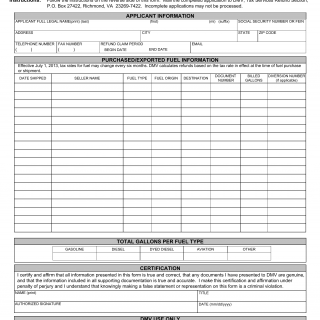

Form TS 219 - Fuel Tax Refund Application - Exports serves as a means to apply for a fuels tax refund on fuel purchased in bulk in Virginia and subsequently exported to another state. This form assists in claiming a refund for fuels tax paid on fuel exported out of Virginia.

The parties involved include entities involved in bulk fuel purchases, fuel exporters, and the Virginia Department of Motor Vehicles. The form includes sections for fuel purchase details, export information, and refund request.

Key sections encompass fuel purchase specifics, export destination, tax payment, and refund request amount. Accurate reporting of fuel export and tax payment is essential for successful refund application.

For instance, a fuel distributor who purchases fuel in bulk in Virginia and then exports it to another state would complete this form to apply for a refund on the Virginia Fuels Tax paid for the exported fuel.

No direct related forms are mentioned, but an alternative could involve similar tax refund application forms for exports in other industries.