TX HHS Form 3051. Statement of Self-Employment Income

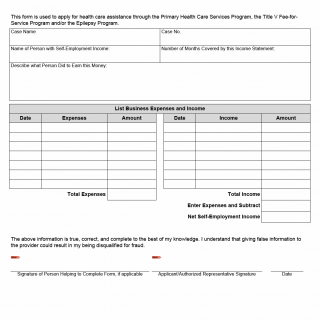

Form 3051 is used by individuals who are self-employed and applying for health care assistance under the Primary Health Care Services Program, the Title V Fee-for-Service Program, or the Epilepsy Program. Because self-employment income is not documented through traditional pay stubs, the state requires applicants to provide a clear, itemized statement of how income was earned and what business expenses were incurred.

This form helps program staff determine whether an applicant meets income eligibility requirements. It is simple in appearance, but the accuracy of what you report has real consequences for your approval and continued participation.

Purpose of the Form

The state uses Form 3051 to verify monthly net income for individuals who earn money through freelance work, small business operations, contract labor, gig work, and other non-traditional employment. Eligibility decisions depend on your net income — not gross — which means your business expenses play a significant role.

You must complete this form if you are applying for one of the listed programs and you receive income that does not appear on a wage statement (W-2) or a standard pay stub.

Who Should Complete This Form

- Freelancers or contractors (e.g., drivers, cleaners, repair workers, digital service providers)

- Small business owners with no formal payroll

- Seasonal workers who operate independently

- Individuals earning irregular compensation through gig platforms

If you have regular employment documented through employer pay stubs, you generally do not use this form.

Key Sections Explained

Case Name / Case Number

This section identifies your application within the program’s system. Use the exact name and case number provided by the agency or health care provider handling your application. A mismatch can delay processing.

Name of Person with Self-Employment Income

List only the person whose income is being evaluated. In multi-adult households, each self-employed person may need their own Form 3051.

Number of Months Covered

You must specify the period your income statement reflects. Most applicants report one month, but you may be asked to provide up to three months if your income is highly irregular.

Description of Work Performed

Explain plainly what you do to earn money. Examples: “auto repair from home garage,” “childcare services,” “reselling household goods online,” “independent house cleaning.” Avoid vague descriptions — clarity helps staff understand whether the expenses you list are reasonable.

Business Expenses

Enter each expense separately with the date and amount. Examples may include:

- Supplies and materials

- Gas or travel expenses related to work

- Tools or equipment purchased

- Advertising or platform fees

Only list expenses directly tied to earning your income. Personal living costs (rent, groceries, personal vehicle repairs) are not allowable.

Income Received

Record each payment you received during the same period. Include all cash, checks, digital payments, and platform payouts. Round to the nearest dollar if needed, but avoid estimating when possible.

Net Self-Employment Income

Subtract total expenses from total income. The result is the amount the program uses to assess eligibility. Providing incorrect totals — even accidentally — can lead to delays or eligibility issues.

Certification Section

Signing the form means you are declaring the information to be true and complete. Misrepresentation can result in disqualification or agency review.

Common Mistakes Applicants Make

- Listing personal expenses as business expenses

- Forgetting to include cash income

- Using estimates instead of real amounts

- Leaving out the time period covered

- Not explaining the type of work they perform

Practical Tips for Filling Out Form 3051

- Gather bank statements, payment app reports, and receipts before starting.

- Report income and expenses for the same exact period.

- Write clear, simple descriptions of your work activities.

- Keep receipts — you may be asked to show them later.

- Double-check your math before signing.

Examples of When This Form Is Needed

- A rideshare driver applying for the Epilepsy Program must document net monthly income after fuel and maintenance expenses.

- A house cleaner with variable weekly clients applies for the Primary Health Care Services Program and needs to show income for the past 30 days.

- A self-employed handyman earns money through small cash-based jobs and must list both income and supply expenses.

- A parent selling handmade crafts online applies for Title V services for a child and needs to verify irregular monthly earnings.

Required Documents

- Receipts for listed expenses

- Bank statements or app payment history (Cash App, Venmo, PayPal, etc.)

- Invoices or sales confirmations (if applicable)

- Any existing bookkeeping records

FAQ

- Can I include expenses without receipts? Some programs allow reasonable expenses without receipts, but you may be asked to justify them.

- Do I report income before or after platform fees? Report the amount you actually received after fees; list fees separately as expenses if relevant.

- What if my income changes month to month? You may be asked to complete multiple monthly forms to show variation.

- Should household members combine income on one form? No. Each self-employed person fills out their own Form 3051.

- What happens if I make a mistake? Contact your provider immediately so they can update or request a corrected form.

- Do cash payments count? Yes — all earned income must be reported.

Micro-FAQ (Short Answers)

- Purpose? To verify net income for health care assistance programs.

- Who files? Anyone with self-employment income applying for these programs.

- Period? Typically one month, unless asked for more.

- Allowable expenses? Only business-related costs.

- Attachments? Receipts, statements, payment records.

- Submitted to? The provider or agency handling your application.

- Cash income? Must be reported.

- Signature required? Yes, to certify accuracy.

Related Forms

- Income Verification Form

- Self-Employment Ledger

- Residency Verification Statement

- Primary Health Care Services Program Application

Form Details

- Form Name: Statement of Self-Employment Income

- Form Number: 3051

- State/Region: Texas

- Program: Primary Health Care Services / Title V FFS / Epilepsy Program

- Revision Date: March 2023