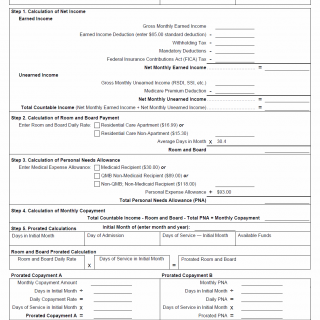

TX HHS Form 1032. Residential Care Copayment Worksheet

The Residential Care Copayment Worksheet (TX HHS Form 1032) is a practical tool designed to help individuals calculate their copayment amounts for residential care services. This form is typically used in situations where an individual requires long-term care services, such as assisted living or nursing home facilities, and needs to determine their monthly copayment amount.

The worksheet guides users through three steps: calculating net income, determining room and board payment, and calculating personal needs allowance. Key features of the form include required information such as gross earned income, withholding tax, and mandatory deductions, as well as conditions for calculating unearned income and total countable income. The form also outlines responsibilities for entering specific rates and allowances, and provides procedures for prorating copayment amounts.

By using this worksheet, individuals can ensure accurate calculations of their copayment amounts and make informed decisions about their long-term care services. Key points to keep in mind when filling out the Residential Care Copayment Worksheet include:

- Calculating net income by subtracting deductions from gross earned income

- Determining room and board payment based on daily rates and average days in a month

- Calculating personal needs allowance by adding medical expense allowances and personal expense allowances

- Prioritizing available funds to ensure accurate copayment calculations