Mass RMV - Application for Sales Tax Abatement

Form Application for Sales Tax Abatement serves as a request to apply for a sales tax abatement in Massachusetts. This form is used when an individual or business believes they have been charged excessive or incorrect sales tax and are seeking a refund or adjustment.

This form is important for individuals and businesses that believe they have overpaid sales tax and want to rectify the situation. It provides a process to review and potentially correct any errors in the sales tax calculation.

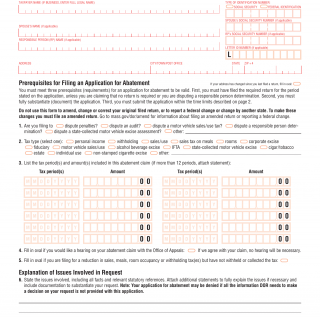

Form Structure

This form involves the individual or business seeking the abatement and the Massachusetts RMV. The form typically includes sections for the applicant's information, details about the transaction in question, a description of the issue, and any supporting documentation.

How to Fill Out and Submit the Form

Completing this form involves providing personal or business details, transaction information, a description of the issue, and any relevant documentation such as receipts or invoices. The completed form and supporting documents can be submitted online or in person at an RMV service center. It's crucial to include clear and comprehensive information to support the abatement request.

For related purposes, the "Application for Refund of Fees and Excises" form can be used to request refunds for fees and excises paid to the RMV. The Application for Sales Tax Abatement, however, specifically deals with sales tax refunds.