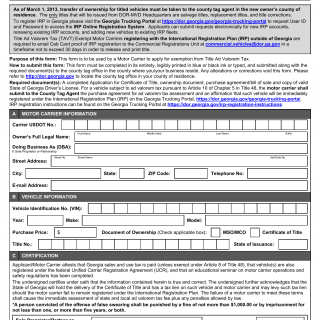

GA DMV Form T-146 Georgia IRP Exemption to State and Local Ad Valorem/Title Ad Valorem Tax Fee Application

Form T-146 Georgia IRP Exemption to State and Local Ad Valorem/Title Ad Valorem Tax Fee Application is used to apply for an exemption from state and local ad valorem (property tax) or title ad valorem tax fees in Georgia for certain vehicles registered under the International Registration Plan (IRP). This form is for businesses and individuals who operate commercial vehicles subject to IRP registration.

Form Structure

This form involves individuals or businesses applying for a tax exemption for their IRP-registered vehicles. It typically includes sections for providing vehicle and owner information, details about the exemption, and any supporting documentation required by the Georgia Department of Revenue.

How to Fill Out and Submit the Form

When completing this form, applicants must provide accurate vehicle and ownership information. They should also clearly state the reasons for requesting the exemption and attach any necessary supporting documents, such as lease agreements or proof of business operations. Once completed, the form should be submitted to the Georgia Department of Revenue through the specified channels.

It's crucial to ensure that the exemption request is valid under Georgia law and that all required documentation is included to support the application.

Related forms: T-146 is specific to IRP tax exemptions, and there may be other forms for different types of vehicle-related tax matters in Georgia.