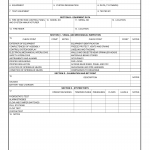

DA Form 7482-R. Compressed Air System Inspection Checklist (LRA)

DA Form 7482-R - Compressed Air System Inspection Checklist (LRA) is used to inspect and assess the condition of compressed air systems within U.S. Army facilities. It aids in maintaining the availability and quality of compressed air for various applications.

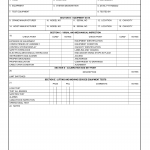

DA Form 7483-R. Wet Pipe Sprinkler System and Fire Detection System Inspection Checklist (LRA)

DA Form 7483-R - Wet Pipe Sprinkler System and Fire Detection System Inspection Checklist (LRA) is utilized to inspect and evaluate the condition of wet pipe sprinkler systems and fire detection systems within U.S. Army facilities. It aids in maintaining fire safety and prevention measures.

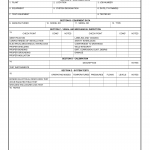

DA Form 7484-R. Lifting and Moving Devices Sys Inspection Checklist (LRA)

DA Form 7484-R - Lifting and Moving Devices Sys Inspection Checklist (LRA) is used to inspect and assess the condition of lifting and moving devices within U.S. Army facilities. It aids in maintaining the safety and functionality of equipment used for lifting and moving heavy loads.

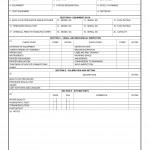

DA Form 7485-R. Elevator Inspection Checklist (LRA)

DA Form 7485-R - Elevator Inspection Checklist (LRA) is utilized to inspect and assess the condition of elevators within U.S. Army facilities. It aids in maintaining the safety and operational functionality of elevators used for vertical transportation.

DA Form 7486-R. High Altitude Electromagnetic Pulse (HEMP) Protection of Mechanical Systems Inspection Checklist (LRA)

DA Form 7486-R - High Altitude Electromagnetic Pulse (HEMP) Protection of Mechanical Systems Inspection Checklist (LRA) is used to inspect and evaluate the readiness of mechanical systems in U.S. Army facilities to withstand the effects of high altitude electromagnetic pulses (HEMP).

DA Form 7487-R. Water Supply and Treatment System Inspection Checklist (LRA)

DA Form 7487-R - Water Supply and Treatment System Inspection Checklist (LRA) is utilized to inspect and assess the condition of water supply and treatment systems within U.S. Army facilities. It aids in maintaining the availability of clean and safe drinking water.

DA Form 7488-R. Sewage Treatment Systems Inspection Checklist (LRA)

DA Form 7488-R - Sewage Treatment Systems Inspection Checklist (LRA) is used to inspect and assess the condition of sewage treatment systems within U.S. Army facilities. It aids in maintaining effective sewage treatment processes and preventing environmental contamination.

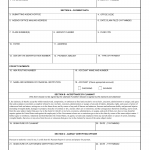

DA Form 7500. Tort Claim Payment Report

DA Form 7500 - Tort Claim Payment Report is used to report payments made as settlements or judgments in tort claims against the U.S. Army. It aids in maintaining accurate records of financial transactions related to tort claims.

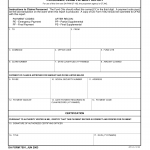

DA Form 7501. Personnel Claim Payment Report

DA Form 7501 - Personnel Claim Payment Report is used to report payments made as settlements or judgments in personnel-related claims against the U.S. Army. It aids in maintaining accurate records of financial transactions related to personnel claims.

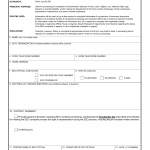

DA Form 7509. Information Inquiry Summary

DA Form 7509 - Information Inquiry Summary is used to record inquiries and requests for information made by individuals or entities outside the Department of the Army. It serves as a record of information provided in response to inquiries.