TX HHS Form 1730. Wage and Benefits Plan Employee Compensation

Form 1730 is a document used in Consumer Directed Services programs to outline and agree upon an employee's compensation, benefits, and withholdings. It ensures clear documentation of wage details, optional benefits, and financial agreements between the employee and employer.

Purpose of the Form

The primary purpose of Form 1730 is to establish and record the wage and benefits plan for employees providing services under Consumer Directed Services. This form helps formalize the compensation structure, including regular and overtime wages, optional benefits, and withholdings. It promotes transparency and compliance with program requirements, ensuring that both the employee and employer understand and agree to the terms. By documenting these details, the form prevents disputes and supports accurate payroll processing, especially since payments are funded by state and/or federal resources.

Who Uses the Form

This form is utilized by employers and employees involved in Consumer Directed Services programs. Employers, who may be individuals receiving services or their representatives, complete the form to specify compensation for hired workers. Employees, such as those providing respite care or other program services, review and sign the form to acknowledge the terms. Financial Management Services Agencies (FMSAs) also receive copies to manage payroll and ensure regulatory adherence. It is particularly relevant in states or regions administering Medicaid-funded or similar consumer-directed care programs.

Applications and Situations Where Needed

Form 1730 is applied when hiring new employees or making changes to existing compensation plans in Consumer Directed Services. It is required for initial setups, such as when an employee is first hired, and for any subsequent modifications, like wage adjustments or benefit additions. Situations include onboarding workers for respite care, personal assistance, or other in-home services. The form is essential in scenarios involving state or federal funding to maintain accountability and prevent fraud. It must be used whenever there's a need to document or revise pay rates, benefits, or withholdings to comply with program guidelines and legal standards.

Sections and Data Requested

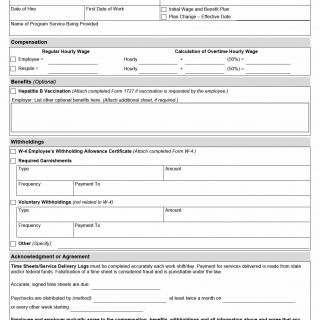

The form is divided into several key sections, each capturing specific information about the employee's compensation and related agreements:

- Employee Identification: Includes the employee's full name (last, first, middle initial), Social Security Number, date of hire, and first date of work. This ensures accurate identification and tracking of employment start dates.

- Plan Type and Effective Dates: Specifies if it's an initial wage and benefit plan or a plan change, with the effective date for changes. It also lists the name of the program service being provided, such as respite care.

- Compensation Details: Covers regular hourly wages for the employee and specific services like respite. It includes calculations for overtime hourly wages, computed as the regular hourly rate plus 50%.

- Benefits (Optional): Allows for optional benefits, such as Hepatitis B Vaccination (requiring attachment of completed Form 1727 if requested). Employers can list other benefits here, with the option to attach additional sheets if needed.

- Withholdings: Details required withholdings from Form W-4 (Employee's Withholding Allowance Certificate, which must be attached). It also covers required garnishments (type, amount, frequency, payment to) and voluntary withholdings not related to W-4 (type, amount, frequency, payment to), plus any other specified items.

- Acknowledgment or Agreement: Emphasizes the need for accurate completion of time sheets/service delivery logs each shift/day. It warns that falsification is fraud, punishable by law. Specifies due dates for accurate, signed time sheets; payroll distribution method (at least twice a month or every other week); and starting date for paychecks. Both employee and employer must sign and date to mutually agree to all terms, with any changes documented and shared with the employee, employer, and FMSA.

Requirements and Guidelines

Several requirements ensure the form's proper use and compliance:

- All sections must be completed accurately, with attachments for supporting documents like Form W-4 or Form 1727.

- Changes to the plan require a new form or amendment, with effective dates noted, and copies provided to all parties including the FMSA.

- Time sheets must be signed and submitted on specified schedules to facilitate timely payroll.

- Payments are from public funds, so accuracy is critical to avoid legal consequences for fraud.

- The form supports flexible compensation but mandates overtime calculations at 150% of regular rates.

- Employers must list benefits clearly, and employees must acknowledge understanding of all terms.

These guidelines help maintain program integrity and protect both parties in consumer-directed care arrangements.

Form Details

- Name: Consumer Directed Services Wage and Benefits Plan Employee Compensation

- Number: Form 1730

- Region/Organization: Applicable to Consumer Directed Services programs, typically under state health and human services agencies (e.g., Medicaid-related in the U.S.)

- Edition Date: October 2013-E