Form MVDB 55. Record of All Wholesale Sales and Retail Sales Registered Out-Of-State - Virginia

Form MVDB 55 - Record of All Wholesale Sales and Retail Sales Registered Out-Of-State is used by motor vehicle dealers to record all wholesale sales and retail sales registered out-of-state. The main purpose of this form is to maintain a comprehensive record of sales transactions involving motor vehicles that are sold to out-of-state buyers.

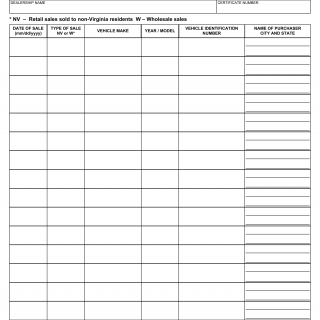

The parties involved in this form include motor vehicle dealers and their out-of-state buyers. The form consists of sections where the dealer must provide details about each sale, including the vehicle information, buyer's details, and the location where the vehicle will be registered.

Important fields in this form include the vehicle's information (make, model, VIN, etc.), the buyer's information, and the registration location. The accuracy and completeness of the information are crucial for maintaining accurate records of sales to out-of-state buyers.

An example scenario for using this form would be a motor vehicle dealer who sells a vehicle to a buyer from a neighboring state. The dealer would complete Form MVDB 55, recording the details of the sale, including the vehicle's information, the buyer's address, and the state where the vehicle will be registered. This information helps the dealer keep track of sales to out-of-state buyers and maintain compliance with reporting requirements.

When filling out this form, it is important for the dealer to provide accurate and complete information about each sale to out-of-state buyers. Maintaining detailed and up-to-date records ensures compliance with reporting regulations and allows the dealer to demonstrate transparency in their sales transactions.

There are no direct alternative forms for recording wholesale and retail sales to out-of-state buyers in the Virginia DMV. However, other states or jurisdictions may have similar forms or reporting requirements for motor vehicle dealers conducting sales with out-of-state buyers.