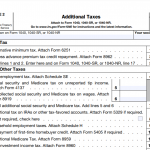

IRS Form 1040 Schedule 2. Additional Taxes

IRS Form 1040 Schedule 2 is an additional tax form used in the United States to report additional taxes owed that cannot be entered directly on Form 1040. This form is used by taxpayers who owe additional taxes beyond what was paid through withholding or estimated tax payments.

Social Security Forms

Social Security is a vital program that provides financial assistance to millions of Americans. However, navigating the various forms and applications related to Social Security can be a daunting task.

IRS Form 1040 Schedule 1. Additional Income and Adjustments to Income

IRS Form 1040 Schedule 1 is an additional tax form used in the United States to report additional income or adjustments to income that cannot be entered directly on Form 1040.

Driver License Test Completion Certificate Form

The Driver's License Test Completion Certificate Form is a document that certifies that the applicant has successfully completed a written and/or practical driver's license test.

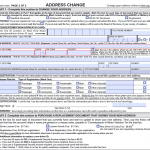

Change of Address Form for driver license

The Change of Address Form for driver license is a legal document that allows a person to update their address on file with the DMV in order to receive their driver's license at their new address.

Parental Consent Form

The Parental Consent Form for driver license is a legal document that allows a minor who is under the age of 18 to apply for a driver's license.

Medical Examination Report Form

The Medical Examination Report Form at DMV is a document used to evaluate an individual's medical fitness to operate a motor vehicle safely.

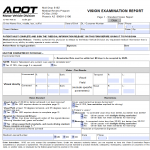

Vision Test Report

The Vision Test Report (Vision Examination Report) form is a document used by the Department of Motor Vehicles (DMV) to evaluate a driver's visual acuity and field of vision. This form is typically required when a person is applying for or renewing their driver's license.

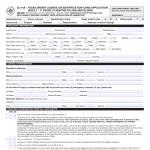

Form DL-14A. Driver License or Identification Card Application Form

The Driver License or Identification Card Application is a form used to apply for a driver's license or identification card. The form is typically issued by the Department of Motor Vehicles (DMV) in the state where the applicant resides.

Health History Form

A Health History Form is a document that collects information about a person's medical history, including past illnesses, surgeries, allergies, medications, and family medical history.