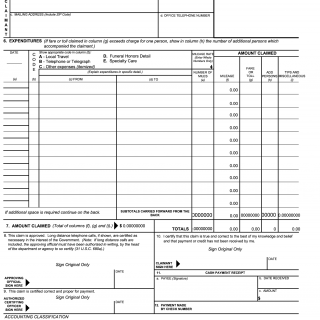

OF 1164. Claim for Reimbursement for Expenditures on Official Business

The OF 1164 form is a government form used by federal employees in the United States to claim reimbursement for expenses incurred while on official business. The form is used to request reimbursement for expenses such as travel, lodging, meals, and other business-related expenses.

The purpose of the OF 1164 form is to provide a record of the expenses incurred by federal employees while on official business and to allow for reimbursement of those expenses. The form is used to ensure that federal employees are reimbursed for expenses that are necessary and reasonable for conducting official business.

The OF 1164 form consists of several parts, including:

- Part I: Claimant Information - This part includes information about the federal employee making the claim, including their name, address, and agency.

- Part II: Travel Information - This part includes information about the travel, including the purpose of the trip, dates of travel, and destination.

- Part III: Itemized List of Expenses - This part includes an itemized list of the expenses incurred while on official business, including travel, lodging, meals, and other expenses.

- Part IV: Certification - This part includes certification by the federal employee's supervisor that the expenses are reasonable and necessary for conducting official business.

The most important fields on the OF 1164 form are typically those in Part III, which include the itemized list of expenses incurred while on official business.

The OF 1164 form is typically compiled by federal employees who have incurred expenses while on official business. The parties to the document are the federal employee making the claim and the agency responsible for processing the claim.

When compiling the OF 1164 form, it is important to provide accurate and detailed information about the expenses incurred while on official business. The form should be certified by the federal employee's supervisor to ensure that the expenses are reasonable and necessary for conducting official business.

The advantages of the OF 1164 form are that it provides a standardized format for claiming reimbursement for expenses incurred while on official business, which makes it easier for federal employees to claim reimbursement and for agencies to process those claims.

Some problems that can arise when filling out the OF 1164 form include providing inaccurate or incomplete information, which can delay or prevent reimbursement of expenses. Additionally, if the expenses claimed are not reasonable or necessary for conducting official business, the claim may be denied.

Related forms to the OF 1164 include the SF 1164 and SF 1164A forms, which are used for requesting reimbursement for expenses related to official government travel. An alternative form to the OF 1164 is the Standard Form 1012, which is used for requesting reimbursement for expenses related to training or education.

The OF 1164 form is typically submitted to the federal employee's agency for processing. The agency will review the claim and either approve or deny the reimbursement request. The form and any related documentation are stored by the agency as part of their records.