Thank You Letter to Boss

A thank you letter to a boss is not a formal document that requires specific formatting or fields. It is simply a letter expressing gratitude to a supervisor or manager for their guidance, support, or mentorship.

Thank You Letter for a Scholarship

A Thank You Letter for a Scholarship is a document used to express gratitude to an individual or organization that has provided financial support for education.

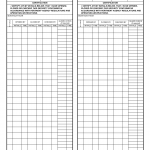

SF 702. Security Container Check Sheet

Form SF702 is a Security Container Check Sheet. The purpose of this form is to document the movement of classified material between two different security containers. It is used to ensure that classified material is properly controlled, accounted for, and protected.

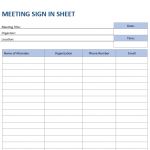

Meeting Sign-In Sheet

A Meeting Sign-In Sheet is a form used to document the attendance at a meeting. The form typically includes the names of all attendees, the date, and any additional details that need to be recorded.

Meeting Request Email

A Meeting Request Email is a document that is used to set up a meeting between two parties. The request typically includes the proposed time and location of the meeting, a description of the meeting’s purpose, the names of the participants, and any other relevant details.

Meeting Follow-Up Email

A Meeting Follow-Up Email is an important document that is sent after a meeting to confirm the attendees, document the topics discussed and pave the way for any future interactions between the parties involved.

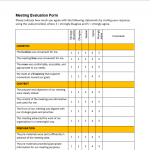

Meeting Evaluation Form

A Meeting Evaluation Form is a form used to collect feedback from attendees of a meeting. It is a way for organizers to ensure that the meeting was successful and that attendees were satisfied with the how things were handled.

Meeting Forms and Templates

Meetings are an integral part of any organization, whether it's a startup, a small business, or a multinational corporation. The success of a meeting depends on various factors, including an agenda, minutes, and action items.

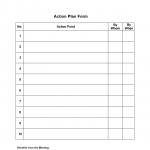

Meeting action plan template

A meeting action plan is a document that outlines the plan of action that needs to be taken after a meeting. It is used to keep track of the various tasks that were discussed during the meeting, who is responsible for each task, and by when it needs to be completed.

Meeting agenda template

A meeting agenda template is a pre-designed document used to plan and organize a meeting. The template outlines the topics to be discussed, the duration of the meeting, and the expected outcomes for each topic.