SF 1094. The United States Tax Exemption Form

SF1094, also known as the United States Tax Exemption Form, is a document that is used to certify that certain types of purchases made by government entities and certain non-profit organizations are exempt from taxation. The purpose of the form is to provide evidence of this exemption to vendors who are selling goods or services to these entities.

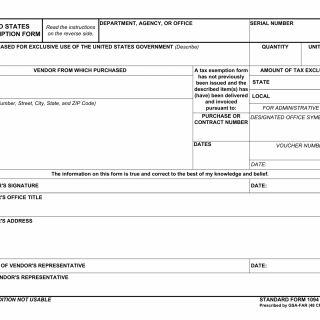

The form consists of several parts, including the entity information, the exemption information, and the signature of an authorized representative of the entity. The most important fields on the form include the name of the entity, the type of exemption being claimed, and the signature of the authorized representative.

This form is typically compiled by government entities and non-profit organizations that are exempt from federal taxation due to their status. The parties to the document typically include the entity that is purchasing goods or services, and the vendor that is selling those goods or services.

When compiling this form, it is important to ensure that all required fields are completed accurately and that the form is signed by an authorized representative of the entity. Any errors or incomplete information could result in the denial of the tax exemption.

The advantages of this form are that it allows eligible entities to purchase goods and services without paying taxes, which can result in significant savings. However, problems can arise when filling out this form, such as completing the wrong exemption information or leaving out necessary information. In these cases, the vendor may refuse to honor the tax exemption or the IRS may audit the entity and require repayment of taxes owed.

Related forms include Form W-9, which is used to provide taxpayer identification information to vendors, and Form 990, which is used to report financial information for tax-exempt organizations. Alternative forms to SF1094 include state-specific tax exemption forms, which may vary in their requirements and guidelines.

The completed form is typically submitted to the vendor at the time of purchase. The vendor may keep a copy for their records, while the entity should keep a copy in their own records as well. If audited, the entity may be required to provide evidence of their tax-exempt status in the form of the SF1094.