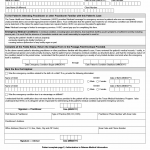

TX HHS Form H3038-P. CHIP Perinatal - Emergency Medical Services Certification

Form H3038-P is used in Texas to document that a non-citizen patient received treatment for a true medical emergency.

TX HHS Form H1988. Disaster Assistance Grants

The TX HHS Form H1988, Disaster Assistance Grants, provides financial assistance to individuals and households affected by a major disaster. The form is administered by the Federal Emergency Management Agency (FEMA) and the Texas Health and Human Services Commission (HHS).

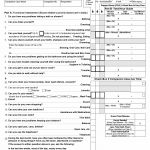

TX HHS Form H2060. Needs Assessment Questionnaire and Task/Hour Guide

This article explains Form H2060 — Needs Assessment Questionnaire and Task/Hour Guide in plain, practical language.

TX HHS Form H2581. Choices Noncooperation Report

The TX HHS Form H2581, Choices Noncooperation Report, helps resolve issues related to non-participation or lack of cooperation from clients in the Temporary Assistance for Needy Families (TANF) program.

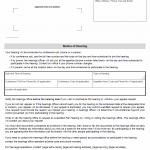

TX HHS Form H4803. Notice of Hearing

The TX HHS Form H4803, Notice of Hearing, serves as a vital tool for individuals appealing health-related decisions made by the Texas Health and Human Services (HHS).

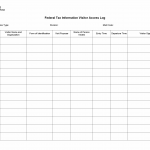

TX HHS Form H1866. Federal Tax Information Visitor Access Log

The TX HHS Form H1866, Federal Tax Information Visitor Access Log, is a practical tool for tracking visitor access to facilities where sensitive tax information is handled.

TX HHS Form H3675. Application Acknowledgement

The TX HHS Form H3675, Application Acknowledgement, is a crucial document for individuals interested in the STAR+PLUS Home and Community Based Services (HCBS) program.

TX HHS Form H2776. Job Search Worksheet for TANF Employment Hardship Exemption

The TX HHS Form H2776, Job Search Worksheet for TANF Employment Hardship Exemption, is a crucial tool in helping individuals navigate the Texas Temporary Assistance for Needy Families (TANF) program.

TX HHS Form H1832. Affidavit for Meal Providers to the Homeless

The TX HHS Form H1832, Affidavit for Meal Providers to the Homeless, is a crucial document that helps meal providers comply with federal regulations and guidelines.

TX HHS Form H1833. Your Medicaid Benefits Are Ending Cover Letter

The TX HHS Form H1833, "Your Medicaid Benefits Are Ending: Cover Letter," helps individuals who are nearing the end of their Medicaid benefits.