Mileage Log

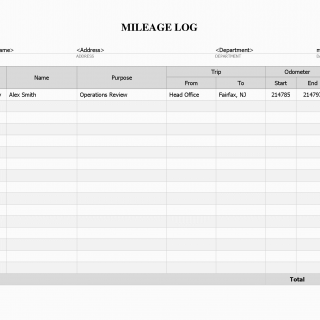

A mileage log is a document used to track the distance traveled by a vehicle for business purposes. It is important for individuals or businesses who use their vehicles for work-related travel to keep accurate records of their mileage for tax purposes. The log consists of several parts, including the date of the trip, the starting and ending mileage, the purpose of the trip, and the destination.

When writing a mileage log, it is important to consider the parties involved, such as the driver and the company they work for. The driver will need to keep track of their mileage for reimbursement or tax deduction purposes, while the company will need to keep accurate records for tax and accounting purposes.

To complete a mileage log, the driver will need to record the starting and ending mileage for each trip, as well as the date, purpose, and destination. Additional documents that may need to be attached include receipts for gas, tolls, and parking fees.

Mileage logs are commonly used by businesses with company vehicles, as well as self-employed individuals who use their personal vehicles for work-related travel. They are also used by employees who receive a mileage reimbursement from their employer.

Strengths of using a mileage log include accurate record-keeping for tax and accounting purposes, as well as the ability to claim a tax deduction for business-related mileage. Weaknesses include the time and effort required to maintain the log, as well as the potential for errors or inaccuracies.

Alternative forms to a mileage log include GPS tracking systems or mobile apps that automatically track mileage. However, these options may be more expensive and may not be necessary for individuals or small businesses.

In terms of future implications, maintaining an accurate mileage log can have significant tax benefits for individuals and businesses. It is important to keep the log up-to-date and to store it in a safe place for future reference.

Mileage logs can be submitted to a company's accounting or HR department for reimbursement or tax purposes. They can also be stored electronically or in hard copy for future reference.