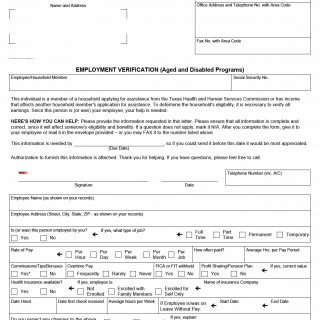

TX HHS Form H1028-A. Employment Verification (Aged and Disabled Programs)

The Employment Verification form (Form H1028-A) is used by the Texas Health and Human Services Commission (HHSC) to confirm wages for individuals applying for benefits under Aged and Disabled Programs. Because financial eligibility is determined primarily by accurate income reporting, employers play a crucial role in certifying the applicant’s earnings, employment status, insurance availability, and any recent changes that may affect eligibility.

This form may look straightforward, but it directly impacts whether a vulnerable adult receives medical assistance, long-term care support, or related benefits. The explanation below walks through each section in practical, clear language so that employers, HR staff, and applicants know exactly how to use it.

Purpose of Form H1028-A

The form allows HHSC to verify employment information that the applicant cannot prove through pay stubs alone. It is typically required when:

- pay stubs are missing, unclear, or incomplete;

- income has recently changed (new job, reduced hours, layoffs);

- the applicant’s work involves tips or irregular pay;

- the employer must confirm insurance availability or employment status.

Employers are legally permitted to release this information because the applicant signs an authorization for disclosure, which accompanies the form.

Explanation of Key Sections

Employee Identification

This section captures the employee’s name, address, and Social Security Number. This must match the employer’s records exactly. Errors here often result in processing delays.

Employment Status

The employer confirms whether the person is currently employed, was employed in the past, or has never been an employee. HHSC uses this information to determine if income should be counted or if the applicant needs to provide separation documentation.

Job Type and Pay Structure

- Job classification: full-time, part-time, permanent, temporary.

- Rate of pay: hourly, daily, weekly, monthly, or per job.

- Pay frequency: how often the employee receives paychecks.

- Average hours: a key factor in determining benefit eligibility.

Applicants often make mistakes by guessing or using outdated information. Employers should verify each detail before completing the form.

Additional Earnings

The form asks whether the employee receives commissions, tips, bonuses, or overtime. These payments can significantly change eligibility, especially when they fluctuate throughout months.

Employers must specify how often these payments occur. Vague entries like “varies” or “as needed” commonly lead to HHSC requesting further clarification.

Deductions and Benefits

- FICA/FIT withholding: confirms legitimate employment and payroll setup.

- Retirement plans: indicates whether the employee participates in profit-sharing or pension programs.

- Health insurance: whether available, and whether the employee is enrolled (self-only or family).

Employment Timeline

The employer provides the hire date, date of first paycheck, average weekly hours, and any periods of leave without pay. HHSC uses this timeline to determine how many months of income should be counted.

Expected Changes

Employers should disclose upcoming changes such as scheduled layoffs, reductions in hours, expected promotions, or temporary closures.

Wage Reporting Table (Page 2)

This is the most important section of the form. The employer must list each paycheck within the requested month range, including:

- pay period end date,

- date payment was received,

- actual hours worked,

- gross pay,

- other pay (tips, commissions, bonuses),

- net amount of check.

HHSC staff often verify whether the number of paychecks matches the stated pay frequency; inconsistencies may trigger a re-verification request.

Separation Information

If the employee is no longer working for the company, the employer must list the separation date, reason, and final payment details. This information determines whether HHSC should expect continuing income.

Employer Certification

The employer signs, dates, and provides contact information. HHSC may call to confirm unclear entries, so accuracy is essential.

Practical Tips for Completing the Form

- Use payroll records rather than memory to avoid incorrect dates or amounts.

- If a field does not apply, enter “N/A” rather than leaving it blank.

- Attach a short note if pay varies widely (seasonal work, construction, tips).

- Ensure pay periods and pay dates are consistent throughout the wage table.

- Return the form before the due date listed at the top to avoid delays in the applicant’s benefits.

Examples of Real-Life Situations

- A home-care worker with irregular hours: HHSC requests the form because weekly pay varies depending on client schedules.

- An elderly applicant recently returned to part-time work: The caseworker needs updated income information to adjust benefit levels.

- A worker who earns tips in a restaurant: Pay stubs don’t show cash tips, so the employer must confirm total earnings.

- A terminated employee applying for assistance: HHSC must verify the final paycheck and reason for separation.

Documents Commonly Required Along With This Form

- Recent pay stubs (if available)

- Employment authorization (signed by the applicant)

- Employer statement on company letterhead (if pay varies significantly)

- Termination letter (if applicable)

FAQ

- Do employers have to complete this form? Yes. Once an employee authorizes release, employers are expected to provide accurate wage information.

- What if an employee works irregular hours? Employers should record hours and earnings exactly as shown in payroll records.

- How far back do wages need to be listed? HHSC will specify the month range at the top of page 2.

- Can employers fax the form? Yes, faxing is acceptable and the number appears at the top of the form.

- What happens if the form is late? The applicant’s benefits may be delayed or denied until verification is received.

- Can the employer give the form directly to the employee? Yes; this is often the fastest method of return.

- Is this form used for tax purposes? No. It is strictly for benefit eligibility determination.

Micro-FAQ (Short Answers)

- What is this form for? To verify employment and wages for Texas benefit programs.

- Who completes it? The employer or payroll representative.

- Who submits it? Either the employer or the employee, depending on instructions.

- Deadline? The date listed at the top of the form.

- What documents may be attached? Pay stubs, employer notes, termination letters.

- Where is it sent? To the HHSC office listed in the header.

- Is employee authorization required? Yes, and it is attached to the form.

- Does HHSC accept faxes? Yes.

- Is it mandatory? Yes, if HHSC requests it.

Related Forms

- Texas Form H1028 — Employment Verification

- Form H1029 — Self-Employment Verification

- Form H1000 — Application for Assistance

- Form H1020 — Request for Information

Form Details

- Form Name: Employment Verification (Aged and Disabled Programs)

- Form Number: H1028-A

- Region: Texas Health and Human Services Commission

- Edition Date: 07-2005