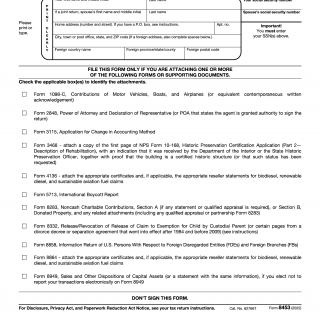

IRS Form 8453. U.S. Individual Income Tax Transmittal for an IRS e-file Return

IRS Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return, is a document that is used by individual taxpayers to transmit their electronic tax return to the Internal Revenue Service (IRS). The form is typically submitted alongside Form 1040, U.S. Individual Income Tax Return, and is used to verify the taxpayer's identity and to confirm that they agree with the information contained in their tax return.

The form consists of several important fields, including the taxpayer's name, Social Security number, and signature. Additionally, the form requires the taxpayer to provide information about their tax return, including the tax year, the type of return being filed, and the tax owed or refund expected. The form also includes a section for the taxpayer to indicate whether they are authorizing a third-party to act on their behalf.

When completing Form 8453, taxpayers will need to have their tax return information readily available, including their income, deductions, and credits. They may also need to attach additional documentation or schedules, depending on the complexity of their tax return.

One important consideration when completing Form 8453 is to ensure that all information is accurate and complete. Any errors or omissions could result in delays or penalties from the IRS. Additionally, taxpayers should keep a copy of the form and any supporting documentation for their records.

An example of an application of Form 8453 is a taxpayer who has filed their tax return electronically and needs to verify their identity and agreement with the information contained in their return. This form is essential for e-filing and ensures that the tax return is properly transmitted to the IRS.

Strengths of Form 8453 include its ability to streamline the process of submitting an electronic tax return and its ability to verify the taxpayer's identity. Weaknesses may include the potential for errors or omissions, which could result in delays or penalties.

Alternative forms to Form 8453 include Form 8453-FE, U.S. Estate or Trust Income Tax Declaration and Signature for Electronic Filing, and Form 8879, IRS e-file Signature Authorization. These forms serve similar purposes but may have different requirements or fields.

Completing and submitting Form 8453 is essential for taxpayers who are filing their tax return electronically. It ensures that their tax return is properly transmitted to the IRS and that their identity is verified. The form can be submitted electronically or by mail and should be kept for the taxpayer's records.