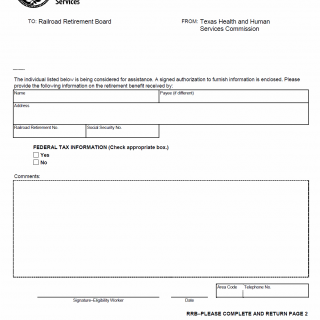

TX HHS Form H1026-FTI. Verification of Railroad Retirement Benefits

The TX HHS Form H1026-FTI, Verification of Railroad Retirement Benefits, is a crucial document that helps resolve issues related to retirement benefits. This form is typically used in situations where an individual's eligibility for assistance is being considered by the Texas Health and Human Services Commission (HHS). The form requires information from the Railroad Retirement Board (RRB) regarding the individual's federal tax information.

The form asks the RRB to provide specific details about the retirement benefit received, including whether it is subject to federal taxation. This information is essential for determining the individual's eligibility for assistance. The form also includes a section for the individual's signature and date of eligibility. By completing this form, the RRB can verify the accuracy of the information and ensure that the individual receives the correct benefits.

Key features of this form include the requirement to provide federal tax information and the need for the RRB to confirm the accuracy of the information. The form is an important tool for resolving issues related to retirement benefits and ensuring that individuals receive the assistance they are eligible for. By completing this form, the RRB can verify the individual's eligibility and provide accurate information to support their application.

- This form is used in situations where an individual's eligibility for assistance is being considered by the Texas Health and Human Services Commission (HHS).

- The form requires information from the Railroad Retirement Board (RRB) regarding the individual's federal tax information.

- The RRB must confirm the accuracy of the information provided on the form.