LDSS-2853. Statement Offering Personal Allowance Account

Form LDSS-2853 - Statement Offering Personal Allowance Account is a form used for calculating a personal allowance from a household's income. It is used to determine the amount of aid that a family qualifies for in the form of cash assistance or other benefits from the NYS Office of Children and Family Services.

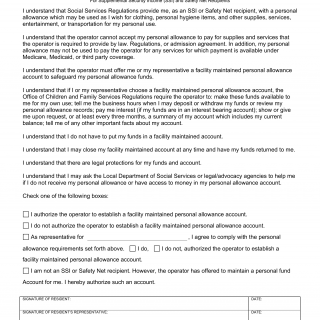

The form consists of two main sections. The first section contains information about the applicant and the household members, including names, birthdates, and Social Security numbers. The second section is for the calculation of the personal allowance, and requires detailed information about the household's income, expenses, deductions, and other allowances.

Important fields in this form include the household's income and expenses, as well as the deductions and other allowances. The amount of income and deductions must be accurate and complete, as it will be used to determine the personal allowance that the family qualifies for. Incorrect or incomplete information may result in the family receiving a lower allowance than they would otherwise qualify for.

This form would be used in a situation where a family is applying for cash assistance or other benefits from the NYS Office of Children and Family Services. Specific instructions or guidelines for completing the form can be found on the form itself. The purpose of using the form is to accurately calculate the amount of aid that a family qualifies for based on the household's income and expenses.

Alternative forms that may be used in similar transactions include the Home Energy Assistance Program (HEAP) form and the Supplemental Nutrition Assistance Program (SNAP) form. Additional documents may be required when filling out the form, depending on the family's circumstances.