TX HHS Form H0070. Food Stamps Streamlined Reporting (Income Calculation Worksheet)

The Food Stamps Streamlined Reporting (Income Calculation Worksheet) Form H0070 is a practical tool designed to help individuals or households report changes in income that may affect their food stamp benefits. This form is typically used when there has been an increase in income for any reason, such as a pay raise or additional sources of income.

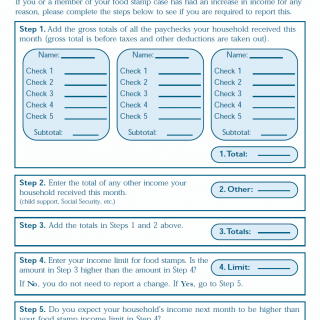

The form consists of four steps: calculating the gross total of all household income, entering other sources of income, adding the totals, and comparing them to the food stamp income limit. The user must determine if their new income exceeds the limit and follow the instructions accordingly. If the answer is yes, they must report the change by calling or completing Form 1019.

Key features of this form include the requirement to calculate gross total household income, entering other sources of income, and determining whether the new income exceeds the food stamp income limit. The user's responsibility is to accurately complete the form and follow the instructions for reporting changes in income. By using Form H0070, individuals or households can ensure compliance with food stamp regulations and maintain their benefits.

- This form is used when there has been an increase in household income.

- The user must calculate gross total household income and enter other sources of income.

- The form helps determine if the new income exceeds the food stamp income limit.