TX HHS Form H1049. Client's Statement of Self-Employment Income

Form H1049, titled Facts About Self-Employment Income, is used by the Texas Health and Human Services Commission (HHSC) to collect detailed information about income earned from self-employment. This form helps HHSC determine eligibility and benefit amounts for public assistance programs when an applicant or household member works for themselves rather than for an employer.

Purpose of Form H1049

The main purpose of Form H1049 is to document how much money a person earns from self-employment and what expenses are required to generate that income. Because self-employed individuals do not receive standard pay stubs, HHSC relies on this form as a sworn statement to assess net income accurately.

This form is typically required when someone applying for or receiving Texas benefits earns money independently, such as through freelance work, small business activities, contract labor, or informal services.

Who Must Complete This Form

Form H1049 must be completed if any person included in a Texas benefits case receives income from self-employment. This includes, but is not limited to:

- Babysitters and child care providers

- Landscapers and day laborers

- House cleaners and hair stylists

- Auto mechanics working independently

- People earning money from sales, crops, leases, commissions, or fees

If a person has an employer who issues wages and withholds taxes, they are generally not considered self-employed and do not need this form.

When This Form Is Required — and When It Is Not

You are required to submit Form H1049 when self-employment income affects eligibility or benefit amounts for programs administered by HHSC. This commonly occurs during:

- Initial benefit applications

- Renewals or recertifications

- Reported changes in income

This form is not required if there is no self-employment income or if income is fully documented through employer wage records.

Explanation of Each Section

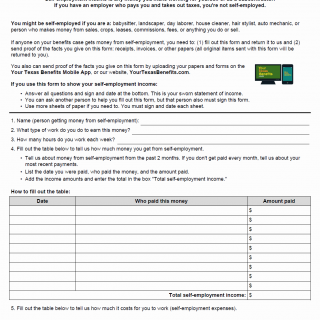

Personal and Work Information

The first section asks for the name of the person earning self-employment income, the type of work performed, and the average number of hours worked per week. This information helps HHSC understand the nature and regularity of the income.

Self-Employment Income Table

This section records income received during the past two months, or the most recent payments if income is irregular. Applicants must list:

- The date payment was received

- The person or business that paid the income

- The amount paid

All income amounts are added together to calculate the total self-employment income.

Self-Employment Expenses Table

This section documents costs necessary to perform the work. Examples of allowable expenses include:

- Advertising and marketing materials

- Business rent, utilities, and property costs

- Labor costs paid to others

- Equipment and operating supplies

- Licenses, permits, and professional fees

Some expenses are not allowed, such as personal use items or certain home-related costs unless they are clearly separate from household expenses.

Certification and Signatures

The form must be signed and dated by the person earning the self-employment income. If someone assisted in completing the form, that person must also sign. By signing, the applicant certifies that the information is true and complete.

Documents Commonly Required

Applicants must submit proof supporting the information reported on Form H1049. Typical documents include:

- Receipts and invoices

- Payment records

- Expense documentation

- Business logs or summaries

Documents can be submitted by mail, uploaded through the Your Texas Benefits website, or sent using the Your Texas Benefits mobile app.

Practical Tips for Completing Form H1049

- Report income and expenses accurately for the correct time period.

- Keep copies of all receipts and records before submitting originals.

- Use additional sheets if more space is needed, and sign each page.

- Double-check totals for income and expenses to avoid delays.

Common Mistakes to Avoid

- Leaving sections blank or unsigned

- Reporting gross income without listing expenses

- Submitting income without proof

- Including personal expenses as business costs

Real-Life Examples

- A house cleaner earning weekly cash payments reports two months of income and supply expenses.

- A freelance mechanic lists customer payments and equipment repair costs.

- A seasonal seller reports irregular income from recent sales.

Legal and Program Context

Form H1049 is required under HHSC program rules to verify income when standard wage documentation is unavailable. Providing false or incomplete information may result in benefit overpayments, repayment obligations, or criminal penalties.

Frequently Asked Questions

Do I need to report cash income?

Yes. All self-employment income, including cash payments, must be reported.

What if my income changes every month?

You should report the most recent two months or the most recent payments if income is irregular.

Can someone help me fill out this form?

Yes, but the helper must also sign the form.

Do I have to send original receipts?

Yes, but originals will be returned after review.

What happens if I make a mistake?

You can contact HHSC to request corrections.

Micro-FAQ

- Purpose: To verify self-employment income for Texas benefits.

- Who files: Anyone earning self-employment income on a benefits case.

- Time period: Usually the past two months.

- Attachments: Receipts, invoices, and proof of income.

- Submitted to: Texas Health and Human Services Commission.

Related Forms

- Texas Benefits Application Forms

- Income Change Report Forms

- Self-Employment Verification Forms

Form Details

- Form Name: Facts About Self-Employment Income

- Form Number: H1049

- Issued By: Texas Health and Human Services Commission

- Region: Texas

- Revision Date: December 2015