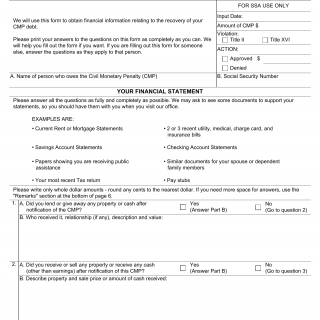

Form SSA-640. Financial Disclosure for Civil Monetary Penatly (CMP) Debt

Form SSA-640, the Financial Disclosure for Civil Monetary Penalty (CMP) Debt, is used by individuals who owe Civil Monetary Penalty debts to the SSA. The main purpose is to provide financial information and disclosure that helps the SSA assess the debtor's ability to pay the CMP debt and determine a reasonable repayment plan.

For example, if someone has been assessed a Civil Monetary Penalty for certain violations related to Social Security programs, they would use this form to disclose their financial situation. The benefits include allowing the SSA to determine a fair and manageable repayment plan based on the debtor's financial status.

The parties involved are individuals who owe Civil Monetary Penalty debts and the SSA. The form consists of sections that require the disclosure of financial information, including income, expenses, and assets. It's important to provide complete and accurate financial details for a fair assessment.