SF 25A. Payment Bond

SF 25A, the Payment Bond, is a legal document used for the protection of individuals and entities that supply labor and materials in various construction projects. This form is required under 40 USC Chapter 31, Subchapter III, Bonds. It serves as a guarantee that the principal (typically a contractor or a company) will make timely payments to subcontractors, laborers, and material suppliers as specified in a construction contract. The Payment Bond ensures that the project's participants are compensated appropriately. OMB Control Number: 9000-0045.

Usage Case: The SF 25A Payment Bond is commonly used in the construction industry, particularly in federal and public works projects. General contractors and prime contractors are often required to provide a Payment Bond as part of the contract. The bond provides a level of security for subcontractors and suppliers who may not have a direct contractual relationship with the general contractor but are involved in the project.

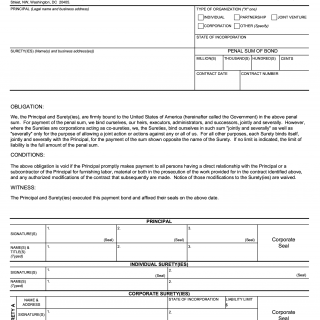

Form Structure: The SF 25A Payment Bond consists of two pages. Here's an overview of its structure:

Page 1:

- Corporate Seal: This section allows corporations to affix their corporate seal.

- Name & Liability Limit: Space to provide the name and liability limit of the principal.

- Address: The principal's business address.

- Name(s) & Title(s) (Typed): Provides space for the typed names and titles of individuals or representatives signing the bond.

- Surety A: Details of the first surety, including name, business address, and the penal sum of the bond.

- Conditions: Explains the conditions of the bond.

- Witness: Space for witnesses.

- Authorized for Local Reproduction: A section that signifies the bond's validity for local reproduction.

Page 2:

- Continuation of information related to corporate sureties (Surety B, Surety C, etc.), including their names, titles, addresses, and liability limits.

Instructions:

- Explains the purpose of the form, which is to protect those supplying labor and materials in construction projects.

- Specifies the full legal name and business address of the principal who must sign the bond. If someone signs in a representative capacity, they must provide evidence of authority.

- Provides instructions for corporate sureties to follow, including appearing on the Department of the Treasury's list of approved sureties and acting within specified limitations.

- Details the requirement for corporate seals for corporations and the execution of the bond by individuals. It mentions adhesive seals for jurisdictions that require them.

- Asks for the typed names and titles of individuals signing the bond.

Additional Information:

- The form must be filled out carefully and accurately to ensure that all parties involved in the construction project are protected.

- When multiple sureties are involved (corporate or individual), their information must be accurately entered to determine liability.

- Deviating from the standard form may require written approval from the Administrator of General Services.

- The bond is typically used in cases where a contractor has been awarded a construction contract and needs to provide assurance that subcontractors and suppliers will be paid appropriately. It prevents unpaid claims and disputes in the construction process.

SF 25A Payment Bond plays a crucial role in construction projects by creating a financial guarantee that ensures all parties involved are compensated fairly and on time.