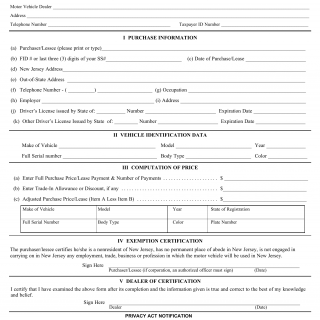

NJ MVC Form ST-10 NJ - Division of Taxation Motor Vehicle Sales and Use Tax Exemption Report

Form ST-10 NJ, the Division of Taxation Motor Vehicle Sales and Use Tax Exemption Report, is used to claim sales and use tax exemption when purchasing a motor vehicle under certain conditions, such as transfers between family members or gifts.

An example scenario for this form is when a person receives a motor vehicle as a gift from a family member and needs to report the exemption to avoid paying sales and use tax.

Form Structure

This form involves individuals who purchase or receive motor vehicles and the New Jersey Division of Taxation. It's structured with sections for providing details about the vehicle, the transaction, and the basis for claiming the exemption.

How to Fill Out and Submit the Form

When claiming sales and use tax exemption, individuals must complete this form accurately and submit it to the New Jersey Division of Taxation. Supporting documentation, such as proof of the relationship between the parties involved, may also be required.

When completing the form, it's important to provide all necessary information and documentation to support the exemption claim.

Related Forms: None specific to this exemption report, as this form addresses the unique circumstances of tax-exempt motor vehicle transactions.