Insurance Appeal Letter

An insurance appeal letter is a formal document that is used to request reconsideration of a denied insurance claim. The letter is written by the policyholder or their representative to the insurance company, explaining why they believe the claim should be approved. In this article, we will discuss the purpose of the insurance appeal letter, its parts, the most important fields, cases in which it is compiled, who are the parties to the document, features to take into account when compiling, advantages, problems that can arise when filling out the form, related forms and alternative forms, differences from analogues, and where and how the form is submitted and stored.

The purpose of an insurance appeal letter is to request reconsideration of a denied insurance claim. The policyholder or their representative writes the letter to the insurance company, explaining why they believe the claim should be approved. The letter should include all relevant information and documentation to support the claim.

The insurance appeal letter typically consists of the following parts:

- Introduction: The introduction should clearly state the purpose of the letter and provide the policyholder's name, policy number, and date of the claim.

- Explanation: This section should provide a detailed explanation of the claim, including the reasons for the denial and any relevant documentation that supports the claim.

- Request for Review: This section should request that the insurance company review the claim and reconsider the denial.

- Conclusion: The conclusion should summarize the request and provide contact information for the policyholder or their representative.

The most important fields in an insurance appeal letter are the policyholder's name, policy number, and date of the claim. These fields help the insurance company identify the claim and ensure that it is reviewed in a timely manner.

An insurance appeal letter is typically compiled when a claim has been denied by the insurance company. The parties involved in the process are the policyholder or their representative and the insurance company.

When compiling an insurance appeal letter, it is important to include all relevant information and documentation to support the claim. The letter should be clear and concise, and should provide a detailed explanation of the claim and the reasons why it should be approved.

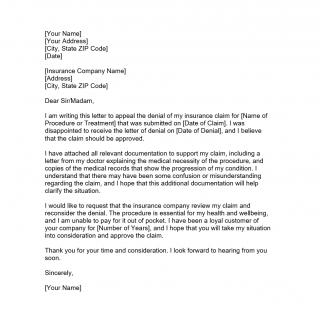

Insurance Appeal Letter sample

[Insurance Company Name]

[Address]

[City, State ZIP Code]Dear Sir/Madam,

I am writing this letter to appeal the denial of my insurance claim for [Name of Procedure or Treatment] that was submitted on [Date of Claim]. I was disappointed to receive the letter of denial on [Date of Denial], and I believe that the claim should be approved.

I have attached all relevant documentation to support my claim, including a letter from my doctor explaining the medical necessity of the procedure, and copies of the medical records that show the progression of my condition. I understand that there may have been some confusion or misunderstanding regarding the claim, and I hope that this additional documentation will help clarify the situation.

I would like to request that the insurance company review my claim and reconsider the denial. The procedure is essential for my health and wellbeing, and I am unable to pay for it out of pocket. I have been a loyal customer of your company for [Number of Years], and I hope that you will take my situation into consideration and approve the claim.

Thank you for your time and consideration. I look forward to hearing from you soon.

Sincerely,

[Your Name]

The advantages of an insurance appeal letter are that it provides the policyholder with an opportunity to request reconsideration of a denied claim. It also allows the policyholder to provide additional information and documentation to support the claim.

The main problem that can arise when filling out an insurance appeal letter is that it may not be clear or concise enough to convince the insurance company to approve the claim. It is important to provide all relevant information and documentation to support the claim and to make a clear and concise argument for why it should be approved.

Related forms to the insurance appeal letter may include a claims form or a claims appeal form. An alternative form could be an email or a phone call to the insurance company. The main difference between the insurance appeal letter and other forms is that the letter provides a formal, written request for reconsideration of a denied claim.

The insurance appeal letter should be submitted to the insurance company by mail, email, or fax. It is important to keep a copy of the letter and any supporting documentation for your records. The insurance company will typically store the letter and any supporting documentation in the policyholder's file.