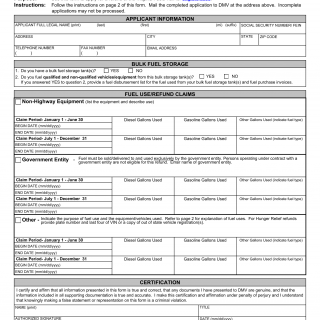

Form TS 216. Application for Fuels Tax Refund - Virginia

Form TS 216 - Application for Fuels Tax Refund is employed to apply for a refund of the Virginia Fuels Tax. This form enables eligible entities or individuals to request a refund for taxes paid on fuel purchases.

The parties involved include individuals or entities eligible for fuels tax refunds and the Virginia Department of Motor Vehicles. The form sections include details about the fuel purchase, tax paid, and refund request.

Important fields encompass fuel purchase information, tax payment details, refund amount, and applicant signature. Providing accurate purchase and tax payment data is essential for successful refund processing.

For example, a business that uses a significant amount of fuel for its operations might complete this form to apply for a refund of the Virginia Fuels Tax on eligible fuel purchases.

No related forms are mentioned, but an alternative could involve forms for similar tax refund applications in other contexts.