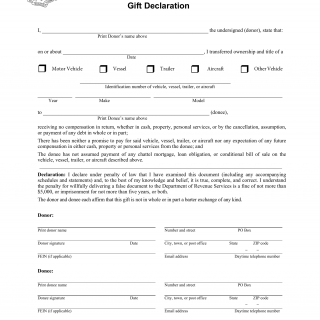

CT DMV Form AU-463. Motor vehicle and vessel gift declaration

Form AU-463 - Motor Vehicle and Vessel Gift Declaration is used to declare a motor vehicle or vessel as a gift when transferring ownership between qualified relationships, such as family members. This declaration is essential to facilitate the transfer of ownership and may exempt the transaction from sales tax... The form is developed by the Connecticut Department of Motor Vehicles, a state agency.

Form Structure

This form involves the donor (gift giver), the recipient (gift receiver), and the DMV. It is structured with sections for the donor's and recipient's personal information, details about the vehicle or vessel being gifted, and a section for the declaration of the gift.

How to Fill Out and submit the Form

The donor and recipient should provide accurate personal information and detailed information about the vehicle or vessel. Both parties must sign the form. Once completed, the form should be submitted as part of the ownership transfer process.

Consider a scenario where a parent wishes to gift their car to their child. This form helps formalize the transfer as a gift, exempting the transaction from sales tax and facilitating the legal and proper transfer of ownership. The purpose of using this form is to ensure that the transfer is recognized under the legal framework for gift transfers.

When completing the form, ensure accurate details about both the donor and the recipient. Verify that the relationship between the parties qualifies for the gift exemption, and ensure that both parties sign the form and provide all required documents.