TX HHS Form 2278. Determination of Type of Meal

The TX HHS Form 2278, "Determination of Type of Meal", is a crucial tool for assessing the meal needs of clients. This form helps determine the type of meals that can be safely stored, prepared, and consumed by individuals.

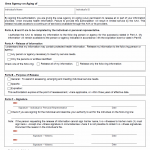

TX HHS Form 2277. Client Information Release

The Texas Health and Human Services' Form 2277, Client Information Release, is a crucial document that enables individuals to authorize the release of their personal information to specific persons or agencies.

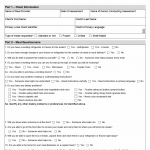

TX HHS Form 2276. Intake

The TX HHS Form 2276, Intake, is a crucial document that helps facilitate the provision of services to individuals in need. This form is typically filled out by recipients seeking assistance from government programs or non-profit organizations.

TX HHS Form 2275. Client Rights and Responsibilities

The TX HHS Form 2275, Client Rights and Responsibilities, is a crucial document that outlines the rights and responsibilities of participants in programs for older individuals and family caregivers.

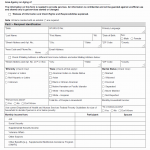

TX HHS Form 2274. Menu Monitoring for DRI and DGA Compliance

The TX HHS Form 2274, "Menu Monitoring for DRI and DGA Compliance," is a practical tool designed to ensure that nutrition programs meet the necessary standards.

TX HHS Form 1020-V. Acknowledgement of Responsibility for Reporting Abuse. Neglect and Exploitation and Reasonable Suspicion of Crime

The TX HHS Form 1020-V, Acknowledgement of Responsibility for Reporting Abuse, Neglect and Exploitation and Reasonable Suspicion of Crime, is a crucial document used to ensure the reporting of incidents that may involve abuse, neglect, or exploitation in state-supported living centers.

TX HHS Form 1020. Acknowledgement of Responsibility for Reporting Abuse. Neglect and Exploitation and Reasonable Suspicion of Crime

The TX HHS Form 1020, Acknowledgement of Responsibility for Reporting Abuse, Neglect and Exploitation and Reasonable Suspicion of Crime, is a crucial document that helps ensure the well-being and safety of individuals receiving services at state-supported living centers.

TX HHS Form 1019. Opportunity to Register to Vote/Declination

The TX HHS Form 1019, Opportunity to Register to Vote/Declination, is a vital document that helps individuals register to vote or decline the opportunity in Texas. This form is typically used by applicants seeking assistance from the Texas Health and Human Services (HHS) agency.

TX HHS Form 1018. Burial or Cremation Assistance Registry Information Request

The TX HHS Form 1018, Burial or Cremation Assistance Registry Information Request, is a crucial tool for healthcare professionals seeking information about providers of financial or other assistance for the transportation, cremation, or burial of embryonic or fetal tissue.

TX HHS Form 2273. Caregiver Assessment

The TX HHS Form 2273, Caregiver Assessment, is a crucial tool for caregivers who require support in providing care to their loved ones. This form helps identify the needs of caregivers and connects them with relevant resources, ultimately improving the quality of care provided.