Form 1095-B appears when minimum essential health coverage was provided outside the Health Insurance Marketplace. It confirms that coverage existed during the year and explains how the system records that fact without requiring any action or filing by the recipient.

What Form 1095-B represents in the system

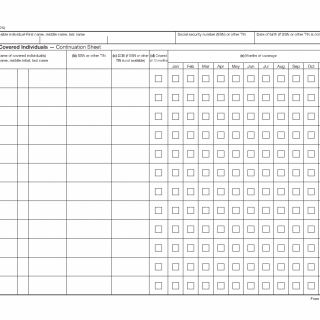

Form 1095-B is an information statement created by an insurance provider, a government program, or a plan sponsor. It documents that one or more individuals had minimum essential coverage for specific months and serves as a system record of that coverage.

Why this form is generated

The form is generated when coverage comes from sources such as an insurer, an employer-sponsored plan not reported on Form 1095-C, or a government program like Medicaid or Medicare. Its purpose is to confirm coverage status rather than to calculate credits or taxes.

What receiving Form 1095-B means

Receiving Form 1095-B means the system recorded qualifying health coverage for the year. This is a normal outcome and does not indicate an error, penalty, or required response.

What Form 1095-B does not do

Form 1095-B is not filled out by the recipient, is not attached to a tax return, and does not by itself affect a refund or balance due. It does not determine eligibility for the premium tax credit and does not trigger a filing obligation.

When questions usually arise

Questions typically arise when the form was not received automatically, when coverage came from multiple sources, or when the recipient is unsure whether any action is required.

If the question is why this form was issued, see why you received Form 1095-B. If the concern is whether anything must be done, see whether you need to do anything with Form 1095-B.

How this form relates to other 1095 forms

Form 1095-B is used only for non-Marketplace coverage. Coverage through a Marketplace or through a large employer is documented using different 1095 forms.

The difference between the 1095 forms is explained in which Form 1095 you received and why.

For the official description of this document, see IRS Form 1095-B document overview.