Form LIC 403. Balance Sheet - California

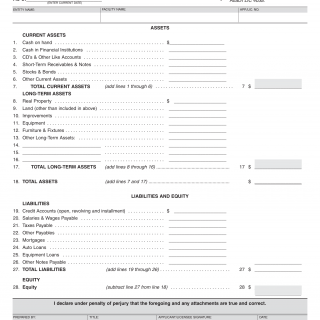

Form LIC 403 is used in California to provide a balance sheet for licensed facilities or programs. The main purpose of this form is to present a snapshot of the licensee's financial position at a given point in time.

The form consists of sections where the licensee provides information related to their assets, liabilities, and equity. This may include details about cash and bank accounts, accounts receivable, property and equipment, loans or debts, and any other financial obligations or investments. The form typically follows the standard balance sheet format with separate sections for assets, liabilities, and equity.

Important fields on this form include accurately documenting the financial information, correctly classifying assets and liabilities, ensuring accuracy in calculations, and complying with any regulations or guidelines regarding financial reporting. It is crucial for the licensee to provide a transparent and accurate snapshot of their financial position when filling out the form.

Application Example: A child care center in California prepares a balance sheet as part of their annual financial reporting requirements. Form LIC 403 would be used to present the center's assets, such as equipment and supplies, accounts receivable, and cash, along with liabilities, including accounts payable and loans. By completing the form, the licensee provides valuable financial information for evaluation, planning, and decision-making purposes.

Related Forms: There are no specific related forms mentioned for Form LIC 403. However, other financial statements or reports, such as income statements or cash flow statements, may be required to provide a comprehensive view of the licensee's financial situation.