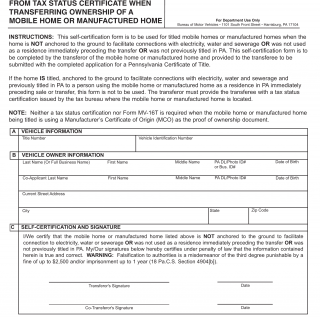

PA DMV Form MV-16T. Self-Certification of Exemption From Tax Status Certificate When Transferring Ownership of a Mobile Home or Manufactured Home

Form MV-16T is a self-certification form used when transferring ownership of a mobile home or manufactured home in Pennsylvania. The purpose of this form is to certify the exemption from tax status for the mobile home or manufactured home being transferred. It is important to fill out this form accurately and completely to ensure a smooth transfer of ownership.

This form consists of several important fields that need to be filled out. These include the owner's name, address, and contact information, as well as details about the mobile home or manufactured home, such as the make, model, year, and vehicle identification number (VIN). Additionally, there are sections where the seller and buyer must sign and date the form acknowledge the transfer of ownership.

When filling out Form MV-16T, it is crucial to consider the accuracy of the information provided. Any errors or omissions may result in delays or complications during the transfer process. It is recommended to double-check all the details before submitting the form to the Pennsylvania Department of Transportation.

An example application of this form would be when an individual is selling their mobile home or manufactured home to another party. By completing Form MV-16T, both the seller and buyer can ensure that the transfer of ownership is properly documented and that the tax status of the property is appropriately certified.

There are no specific alternative forms or analogues directly related to Form MV-16T. However, it is worth noting that other forms may be required depending on the specific circumstances of the transfer. For example, if the mobile home or manufactured home is located in a mobile home park, additional forms or agreements may be necessary to comply with park regulations.