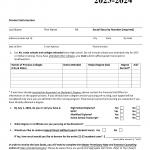

Supplemental Information Form

The Supplemental Information Form is a required document for some colleges and universities during the application process. The main purpose of this form is to gather additional information about the applicant beyond what is included in the standard application form.

Acknowledgement in Research

Acknowledgement in research refers to a section at the beginning of a research paper, thesis or dissertation where the author acknowledges individuals, organizations, or institutions that have contributed to the research project in some way but are not authors or co-authors of the paper.

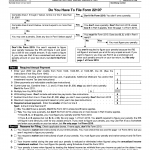

IRS Form 2210. Underpayment of Estimated Tax by Individuals, Estates and Trusts

Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts, is a tax form used by taxpayers who did not pay enough estimated tax throughout the year.

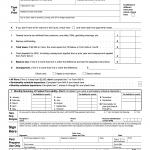

IRS Form 945. Annual Return of Withheld Federal Income Tax

Form 945, Annual Return of Withheld Federal Income Tax, is a tax form used by employers who withhold federal income tax from non-payroll payments to report their annual withholding amount to the Internal Revenue Service (IRS).

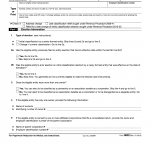

IRS Form 8832. Entity Classification Election

Form 8832, Entity Classification Election, is a tax form used by eligible entities to elect how they want to be classified for federal tax purposes.

IRS Form 7004. Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns

Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, is a form used by businesses to request an automatic extension of time to file certain tax returns.

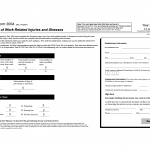

OSHA Form 300A. Summary of Work-Related Injuries and Illnesses

OSHA Form 300A, Summary of Work-Related Injuries and Illnesses, is a form used by employers to report work-related injuries and illnesses that occurred in the previous year.

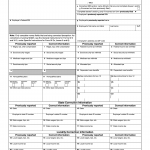

IRS Form W-2 C. Corrected Wage and Tax Statements

Form W-2 C, Corrected Wage and Tax Statements, is a form used to correct errors on previously filed W-2 forms. The main purpose of this form is to provide accurate wage and tax information to the Social Security Administration (SSA) and the Internal Revenue Service (IRS) for employees.

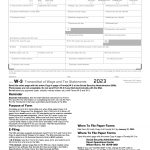

IRS Form W-3. Transmittal of Wage and Tax Statements

Form W-3, Transmittal of Wage and Tax Statements, is a tax form used by employers to transmit employee wage and tax information to the Social Security Administration (SSA). This form is a summary of all the W-2 forms issued to employees and is required to be filed annually.

Teacher Appreciation Letter from Student

A Teacher Appreciation Letter from a Student is a formal letter expressing gratitude from a student to their teacher for their hard work, dedication, and support throughout the academic year.