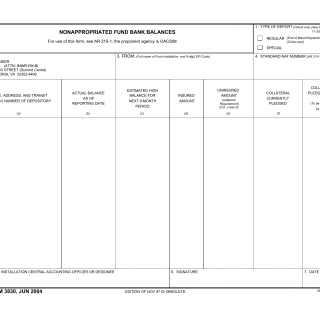

DA Form 3830. Nonappropriated Fund Bank Balances

The DA Form 3830, known as the Nonappropriated Fund Bank Balances form, is used to record and track the bank balances of nonappropriated funds (NAF). This form is typically utilized in military organizations or installations that operate nonappropriated fund activities, such as recreational facilities, clubs, or retail stores.

The form consists of fields that capture important information related to the bank balances of NAF accounts. These fields include the name of the activity, account number, date, beginning balance, deposits, withdrawals, and ending balance. The form allows for recording the financial transactions associated with the NAF accounts, including deposits made, withdrawals made, and any adjustments or transfers.

When filling out the DA Form 3830, it is essential to ensure accuracy and attention to detail. The name of the activity and account number should be recorded correctly to identify the specific NAF account. The date field should reflect the date of the financial transaction being recorded. The beginning balance should represent the balance at the start of the accounting period, while deposits and withdrawals should accurately reflect the financial inflows and outflows during that period. Finally, the ending balance should be calculated based on the beginning balance, deposits, withdrawals, and any adjustments or transfers.

An example application of the DA Form 3830 would be in a military installation that operates various nonappropriated fund activities. By using this form, financial personnel responsible for managing NAF accounts can keep track of the bank balances, ensuring accurate and up-to-date financial records. The form serves as a reference for financial reporting, auditing purposes, and monitoring the financial health of NAF activities.