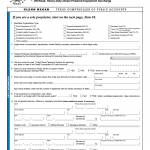

DA Form 2765-1. Request for Issue or Turn-In

The DA Form 2765-1 is a form used by military personnel to request or turn-in items such as equipment, supplies, and ammunition. The purpose of the form is to provide a record of the transaction and ensure accountability for the items being requested or turned in.

DA Form 2627. Record of Proceedings Under Article 15, UCMJ

DA Form 2627, also known as Record of Proceedings Under Article 15, UCMJ, is a legal document used in the United States Army to record the outcome of non-judicial punishment proceedings under Article 15 of the Uniform Code of Military Justice (UCMJ).

GSA Form 3517B. General Clauses (Acquisition of Leasehold Interests in Real Property)

GSA Form 3517B, also known as General Clauses (Acquisition of Leasehold Interests in Real Property), is a legal form used in the United States to document the acquisition of leasehold interests in real property.

New York State Tax Forms

As a taxpayer, you may be required to complete various forms throughout the tax process. The New York State Department of Taxation and Finance offers a variety of forms to help taxpayers manage their tax obligations.

California Social Services LIC Forms

When running a licensed care facility, there are various forms that need to be filled out and submitted to the appropriate agencies. These forms are designed to ensure compliance with regulations and provide important information about the facility's operations.

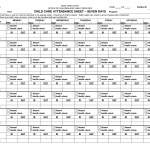

OCFS-6027. Child Care Attendance Sheet - Seven Days

The OCFS-6027 is a Child Care Attendance Sheet that is used for seven days.

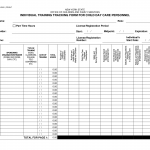

OCFS-4880. Individual Training Tracking Form

The OCFS-4880 Individual Training Tracking Form is a document used to track the progress and completion of training for individuals in New York State.

Texas Business Appliction Permit Forms

If you're doing business in Texas, it's essential to be aware of the various forms required by the state government. From tax permits to exemption applications, there are plenty of documents that you need to file to operate legally.

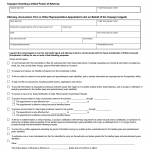

Form 01-137. Taxpayer Limited Power of Attorney

Form 01-137, Limited Power of Attorney, is a legal document used to grant an individual or entity the power to act on behalf of a taxpayer in specific tax matters.

Form AP-201. Texas Application for Sales Tax Permit and/or Use Tax Permit

The Texas Application for Sales Tax Permit and/or Use Tax Permit is a form used to apply for a permit that allows individuals or businesses to sell tangible personal property within the state of Texas. The main purpose of this form is to register for sales and use tax purposes.