Form HSMV 84050. Application for Dealer License Reprint - Florida

Form HSMV 84050 is used in Florida to apply for a reprint of a dealer license. The form is intended for dealerships who need to replace a lost, damaged, or stolen dealer license.

The form consists of several sections and important fields, including:

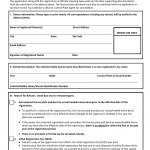

Form HSMV 84045. Registration of Mobile Home Dealer's Salesperson(s) - Florida

This form is utilized for registering the salesperson(s) of a mobile home dealer in the state of Florida. It is necessary for individuals who are involved in selling mobile homes on behalf of a licensed mobile home dealer.

The key components of this form include:

Form HSMV 84026. Assignment of Claim/Suit - Florida

This form is used for the assignment of a claim or lawsuit in the state of Florida. It is typically used when transferring the rights and responsibilities of a claim or a lawsuit from one party to another.

The form consists of several important fields, including:

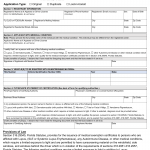

Form HSMV 84019. Application and Claim To Recover Compensation from the Mobile Home and Recreational Vehicle Trust Fund - Florida

Form HSMV 84019 is an application and claim form used in Florida to request compensation from the Mobile Home and Recreational Vehicle Trust Fund.

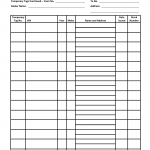

Form HSMV 84016. Temporary Tag Record - Florida

Form HSMV 84016 is a record form used in Florida to document the issuance and use of temporary tags for motor vehicles. This form serves as a record of temporary tag transactions and includes important details about the temporary tag issuance.

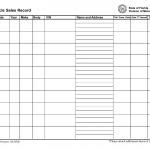

Form HSMV 84014. Vehicle Sales Record - Florida

Form HSMV 84014 is a record form used in Florida to document the sale of a motor vehicle. This form serves as a record of the transaction and contains important information regarding the vehicle sale.

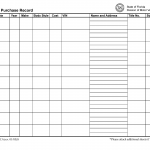

Form HSMV 84013. Vehicle Purchase Record - Florida

Form HSMV 84013 is a record form used in Florida to document the purchase of a motor vehicle. This form serves as a record of the transaction and includes important details about the vehicle purchase.

Form HSMV 83416. Request for Division of Motor Vehicle/Vessel Forms - Florida

Form HSMV 83416 is a request form used in Florida to obtain various motor vehicle and vessel forms issued by the Division of Motor Vehicles (DMV). This form allows individuals to request specific forms required for different transactions or purposes.

Form HSMV 83390. Application for Sunscreening Medical Exemption - Florida

Form HSMV 83390 is an application form used in Florida to request a medical exemption for sunscreening on motor vehicles. This form allows individuals with specific medical conditions to apply for an exemption from the restrictions regarding darkened window tinting.

Form HSMV 83363. Application for License Plate or Decal Refund - Florida

Form HSMV 83363 is an application form used in Florida to request a refund for license plates or decals. This form allows individuals to claim a refund for overpayment, duplicate payments, or underutilized license plates or decals.