Form HSMV BAR1002. Affidavit Of Refusal To Submit To Blood Test - Florida

Form HSMV BAR1002 is used in Florida when an individual refuses to submit to a blood test during a DUI (Driving Under the Influence) investigation. This form serves as an affidavit documenting the refusal and acknowledges the potential consequences of such refusal.

Form HSMV 86065. Notification of Dispute on a Repossession Recovery Attempt for a Motor Vehicle - Florida

Form HSMV 86065 is used in Florida to notify the Department of Highway Safety and Motor Vehicles (DHSMV) about a dispute arising during a repossession recovery attempt of a motor vehicle.

Form HSMV 86064. Affidavit for Golf Cart Modified to a Low Speed Vehicle - Florida

Form HSMV 86064 is used in Florida for individuals who have modified a golf cart to meet the criteria of a low-speed vehicle (LSV) and wish to register it as such.

Form HSMV 86060. Statement of Intent to Relinquish a Dealer License - Florida

Form HSMV 86060 is used in Florida by motor vehicle or mobile home dealers who intend to relinquish their dealer license. This form allows dealers to formally declare their intent to surrender their license and cease their dealership operations.

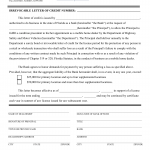

Form HSMV 86059. Florida Mobile Home Manufacturer Irrevocable Letter of Credit - Florida

Form HSMV 86059 is used in Florida by mobile home manufacturers to establish an irrevocable letter of credit.

Form HSMV 86058. Florida Mobile Home Dealer Irrevocable Letter of Credit - Florida

Form HSMV 86058 is used in Florida by mobile home dealers to establish an irrevocable letter of credit.

Form HSMV 86057. Florida Motor Vehicle Dealer Irrevocable Letter of Credit - Florida

Form HSMV 86057 is used in Florida by motor vehicle dealers to establish an irrevocable letter of credit.

Form HSMV 86051. Surety Bond, Recreational Vehicle Manufacturer or Van Converter - Florida

Form HSMV 86051 is used in Florida by recreational vehicle manufacturers or van converters to provide a surety bond as part of the licensing requirements.

Form HSMV 86050. Surety Bond, Mobile Home Manufacturer - Florida

Form HSMV 86050 is used in Florida by mobile home manufacturers to provide a surety bond as part of the licensing requirements. This form is specifically for manufacturers who need to obtain or renew their license to produce mobile homes.

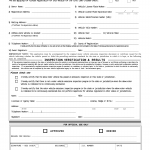

Form HSMV 86029. Application for Reciprocal Inspection Exemption - Florida

Form HSMV 86029 is used in Florida for vehicle owners to apply for an exemption from the requirement of a reciprocal inspection.