Amended vs Corrected Schedule K-1 (Form 1065): What Is the Difference?

Schedule K-1 (Form 1065) may be reissued by a partnership if errors or changes are identified after the original form is provided to partners.

What to Do If Schedule K-1 (Form 1065) Is Late

Schedule K-1 (Form 1065) is often issued later than other tax documents. This is a common situation and does not necessarily indicate a problem.

Do You Need to File If Schedule K-1 Shows No Income?

Schedule K-1 (Form 1065) may show zero income, a loss, or no cash distributions for a tax year. This situation is common and does not necessarily mean the form can be ignored.

Schedule K-1 vs Schedule K-3: What Is the Difference?

Schedule K-1 (Form 1065) and Schedule K-3 are related IRS forms, but they serve different purposes and report different types of information.

Schedule K-1 (Form 1065) for LLC Members

Schedule K-1 (Form 1065) is issued to members of an LLC when the LLC is treated as a partnership for federal tax purposes.

When Do You Receive Schedule K-1 (Form 1065)?

Schedule K-1 (Form 1065) is issued by a partnership to report each partner’s share of income, deductions, credits, and other tax items for the tax year.

Schedule K-1 (Form 1065): Official Overview Based on IRS Instructions

Schedule K-1 (Form 1065) is an IRS tax document used by partnerships to report each partner’s distributive share of income, deductions, credits, and other tax items for the tax year.

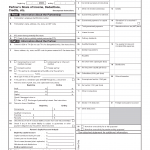

IRS Form 1065. Schedule K-1. Partner’s Share of Income, Deductions, Credits, etc. 2022

Schedule K-1 (Form 1065) for 2024 is an essential IRS document that details a partner’s share of income, deductions, credits, and other financial information from a partnership.

Workplace Complaint Letter

A workplace complaint letter is a formal written document used by an employee to raise concerns about issues in the workplace.

Formal Complaint Letter

A formal complaint letter is a professionally written document used to report a problem or dissatisfaction in a clear, respectful, and structured manner.