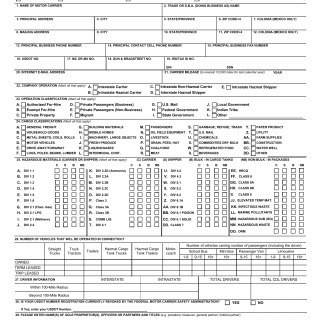

CT DMV Form MCS-150CT. Motor carrier identification report

Form L5 - Municipalities - Assessment Correction Notice serves as a notice sent by municipalities to taxpayers regarding corrections made to the assessed value of a motor vehicle for tax purposes. This form informs taxpayers about adjustments to their vehicle assessment and the resulting tax implications.

Municipalities in Connecticut use this form to notify taxpayers about corrections or adjustments made to the assessed value of their motor vehicle, which may impact the taxes they owe. The form ensures transparency and communication regarding changes to tax assessments.

Form Structure

This form involves municipalities, taxpayers, and the Connecticut DMV. It's structured with sections that outline the details of the correction or adjustment made to the assessed value, the taxpayer's information, and the tax implications of the change.

How to Fill Out and Submit the Form

This form is typically generated and sent by municipalities to taxpayers. Taxpayers receive the form and review the information provided about the correction to their assessed value. If they have questions or concerns, they can contact the municipality's tax authorities for clarification.

Analogous forms could include notifications about property tax assessment changes or similar adjustments.