Form SSA-632-BK. Request for Waiver of Overpayment Recovery

Form SSA-632-BK, issued by the Social Security Administration, is used for the purpose of requesting a waiver of overpayment recovery. Overpayment can occur when an individual has received more funds from Social Security benefits than they were eligible to receive, and this form allows individuals to request a waiver, asserting that they are not at fault for the overpayment, cannot afford to repay the money, or that the overpayment is unfair for some reason.

How to Fill Out and Submit the Form:

To complete and submit Form SSA-632-BK, follow these steps:

-

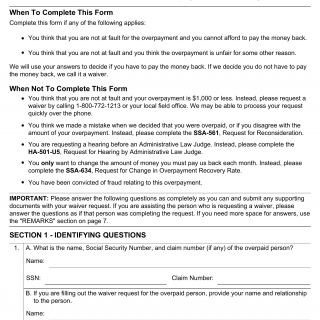

Determine Eligibility (When to Complete): The form should be completed if you believe you are not at fault for the overpayment and cannot afford to pay it back, or if you believe the overpayment is unfair for some other reason. The form helps you request a waiver of overpayment recovery.

-

Avoid Misuse (When Not to Complete): Do not complete this form if you believe that the Social Security Administration made a mistake in determining the overpayment, if you disagree with the amount of the overpayment, if you're requesting a hearing before an Administrative Law Judge, or if you only want to change the monthly repayment amount. In these cases, use different forms specified in the instructions.

-

Section 1 - Identifying Questions: Provide the name, Social Security Number (SSN), and claim number (if any) of the overpaid person. If you're filling out the waiver request for the overpaid person, include your name and relationship to the person.

-

Section 2 - Waiver Request: Indicate the date of the notice for the overpayment you're requesting a waiver for and the reason(s) for requesting a waiver (e.g., not at fault, unable to afford, unfair). Explain the reasons in detail.

-

Section 3 - Needs Based Income: Determine whether you're currently receiving Supplemental Security Income (SSI) payments. If yes, go to page 9 for additional information; if no, continue with the rest of the form.

-

Section 4 - Members of Household: List the names and relationships of household members (spouse and dependents) who depend on you for support and can be claimed on your tax return.

-

Section 5 - Assets - Things You Have and Own: Provide details about cash you have, financial accounts, types of accounts, account balances, income per month from accounts, and other asset information. Attach supporting documents if necessary.

-

Section 6 - Monthly Household Income: List monthly take-home pay for yourself, your spouse, and any dependents. Also, provide information on Social Security benefits, SSI, pensions, and more.

-

Section 7 - Monthly Household Expenses: List your monthly expenses, including rent or mortgage, food, insurance, utilities, and other costs.

-

Remarks Section: Use this section to provide additional information or explanations related to your finances.

-

Authorization and Certification: Sign the form, and provide witness signatures if applicable.

Usage Case:

Form SSA-632-BK is used when individuals receiving Social Security benefits have been overpaid, and they believe they are not at fault, cannot afford to repay the overpayment, or find the overpayment unfair. By submitting this form, they request a waiver of overpayment recovery, and their financial information is assessed to determine eligibility for a waiver.

Form Structure:

Form SSA-632-BK consists of ten pages with the following sections:

-

Page 1: Introduction, purpose of the form, when to complete it, and when not to complete it.

-

Pages 2 to 10: Detailed sections for collecting personal information, financial details, income, assets, expenses, and a remarks section for additional explanations.

-

Page 9: Specific information for individuals receiving Supplemental Security Income (SSI).

-

Page 10: Authorization, penalty clause, certification, and Privacy Act Statement.

This form allows individuals to present their financial situation and reasons for requesting a waiver of overpayment recovery, enabling the Social Security Administration to make a determination based on their circumstances.