MD MVA Form VR-316 - Motor Vehicle Fees

Form VR-316 - Motor Vehicle Fees provides a comprehensive list of motor vehicle fees in Maryland.

MD MVA Form VR-315 - Buying A Vehicle In Maryland

Form VR-315 - Buying A Vehicle In Maryland serves as a guide for individuals purchasing a vehicle in Maryland.

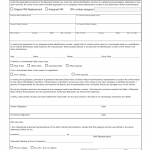

MD MVA Form VR-308 - Application for Maryland County Pride Stickers

Form VR-308 - Application for Maryland County Pride Stickers is used to request county pride stickers that can be affixed to license plates in Maryland.

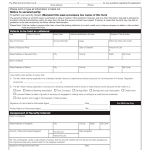

MD MVA Form VR-302 - Commemorative Bay Plate / Agricultural Plate Application

Form VR-302 - Commemorative Bay Plate / Agricultural Plate Application is used to apply for specialty license plates in Maryland.

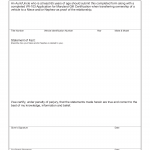

MD MVA Form VR-299 - Certified Statement

Form VR-299 - Certified Statement is a generic form that can serve various purposes depending on the specific use case.

MD MVA Form VR-294 - Tow Truck Certification

Form VR-294 - Tow Truck Certification serves as a document to certify a tow truck for operation in Maryland.

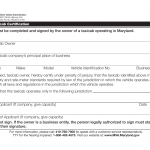

MD MVA Form VR-293 - Taxicab Certification

Form VR-293 - Taxicab Certification is used by individuals or companies seeking to certify a vehicle as a taxicab in Maryland.

MD MVA Form VR-217 - Security Interest Filing Statement

Form VR-217 - Security Interest Filing Statement is used to record a security interest in a vehicle in Maryland.

MD MVA Form VR-198 - Application for Assigned Vehicle Identification Number

Form VR-198 - Application for Assigned Vehicle Identification Number is used to apply for an assigned VIN (Vehicle Identification Number) for a vehicle in Maryland.

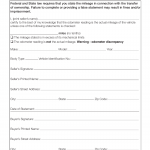

MD MVA Form VR-197 - Odometer Disclosure Statement

Form VR-197 - Odometer Disclosure Statement serves as a legal document to record the mileage of a vehicle during a sale or transfer of ownership in Maryland.