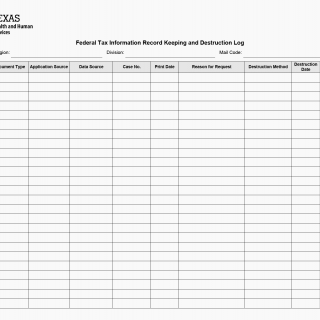

TX HHS Form H1861. Federal Tax Information Record Keeping and Destruction Log

The “Federal Tax Information Record Keeping and Destruction Log” (Form H1861, March 2021-E) is a compliance document used by agencies and staff who handle Federal Tax Information (FTI). Its purpose is straightforward but extremely important: it provides a clear, auditable record of how sensitive tax data was accessed, stored, and eventually destroyed. This form helps organizations prove they are following strict federal requirements for safeguarding confidential tax data.

Although the form itself looks simple, it carries weight. Any mistake in recording destruction details or handling procedures can create compliance issues during federal audits, so understanding each section matters.

Purpose of the Form

This form documents the lifecycle of FTI materials—from where they came from to why they were accessed and how securely they were destroyed. It is mostly used inside state agencies, social services offices, and departments that receive IRS information to determine benefits eligibility or verify income.

- It ensures the agency meets IRS Publication 1075 requirements.

- It prevents unauthorized disclosure of protected tax information.

- It provides a reliable audit trail for federal compliance reviews.

In other words, this form helps organizations answer a critical question: “Can we prove we handled tax information lawfully and securely?”

Explanation of Key Sections

Region / Division / Mail Code

This identifies the exact office responsible for handling the tax record. Many agencies operate across multiple regions, so this information helps auditors locate the correct department if questions arise.

Date

The date the log entry was created. A common mistake is using the destruction date instead—each event should have only one log entry with multiple dates recorded in the appropriate fields.

Document Type

Specifies what kind of FTI material was handled. For example:

- Federal tax returns

- Income verification from IRS data exchanges

- Documents containing Social Security or employer-reported tax details

Application Source / Data Source

These fields help identify where the data originated. For example, whether the information came from a benefits eligibility system, a manual IRS printout, or a federal data match.

Case No.

Links the FTI to a specific case record. This allows internal reviewers to validate why the information was accessed in the first place.

Print Date

The date when the FTI was printed or generated. This matters because printed FTI has strict time limits for retention and must be destroyed using approved methods.

Reason for Request

This explains why the staff member accessed or handled the tax information. Examples include:

- Eligibility verification

- Quality control review

- Fraud investigation

Destruction Method

Lists the method used to dispose of FTI. Acceptable methods include cross-cut shredding, pulping, and approved secure disposal systems. Agencies must use methods compliant with federal rules.

Destruction Date

The exact date the information was destroyed. One of the most common errors is leaving this section blank or writing “N/A,” which is not allowed for printed FTI.

Staff

The staff member responsible for overseeing or performing destruction. This ensures accountability and creates a verifiable chain of custody.

Common Errors to Avoid

- Leaving the destruction date blank.

- Using vague document descriptions like “paperwork.”

- Failing to match case numbers with internal systems.

- Recording destruction before printing (the sequence must match reality).

- Not specifying an approved destruction method.

Practical Tips for Filling Out the Form

- Always complete the form immediately after handling or destroying FTI—waiting increases mistakes.

- Use exact source names (systems, modules, departments) instead of shorthand or acronyms.

- Ensure the destruction method matches agency-approved equipment or contractors.

- Cross-check print dates with internal logging systems to avoid discrepancies.

Examples of Real Situations Where This Form Is Needed

- A caseworker prints IRS income verification for a benefits application and must document when the printout is destroyed.

- An auditor reviews a fraud investigation file containing tax return extracts and needs proof of proper disposal.

- A supervisor conducts a quality check on a division’s handling of federal tax match data and logs the reviewed documents.

- An employee retrieves FTI from a federal data exchange system and must record the reason and destruction details.

Documents Commonly Attached or Referenced

- Case file explaining why FTI was accessed

- Internal print logs

- Proof of destruction (shred logs, contractor certificates)

- Agency procedures for FTI handling

Detailed FAQ

Who is required to fill out this form?

Any staff member who prints, handles, or destroys Federal Tax Information should complete this log entry.

Why is documenting destruction so important?

Federal rules require agencies to prove that printed FTI is not stored indefinitely and is destroyed securely to prevent unauthorized disclosure.

Can digital FTI be recorded on this form?

Yes, if it is printed or if destruction of physical media is involved. Purely digital access is usually tracked by internal system logs.

What destruction methods are acceptable?

Cross-cut shredding, pulping, or any method compliant with IRS Publication 1075 standards.

What happens if the form is incomplete?

Auditors may consider it a compliance failure, which can lead to required corrective actions.

Do staff need supervisor approval to destroy FTI?

This varies by agency, but documentation of destruction is always required.

Can multiple documents be logged in a single entry?

Only if they are part of the same case and handled the same way, at the same time.

Micro-FAQ (Short Answers for Quick Reference)

- Purpose: Track handling and destruction of Federal Tax Information.

- Who completes it? Staff who print or destroy FTI.

- When required? Whenever printed FTI is produced or destroyed.

- Attachments? Shred logs, destruction certificates, case file references.

- Submitted to? Internal agency compliance or recordkeeping systems.

- Retention? According to agency FTI policies.

- Legal basis? IRS Publication 1075 compliance rules.

Related Forms

- FTI Access Log

- Confidential Data Handling Acknowledgment

- Benefit Eligibility Verification Forms

- Internal Case Review Log

Form Details

- Form Name: Federal Tax Information Record Keeping and Destruction Log

- Form Number: H1861

- Edition: March 2021-E

- Region: As specified in the form

- Use: Tracking handling and destruction of FTI