TX HHS Form H1857. Landlord Verification

Form H1857, also known as the Landlord Verification form, is a document used by Texas Health and Human Services (HHS) to confirm a client’s housing situation. Caseworkers rely on this form to verify details such as rent, utilities, household members, and the client’s payment history. The information provided helps determine eligibility for state assistance programs, including SNAP, Medicaid, and TANF.

The form is completed not by the applicant but by their landlord or an authorized representative. Its purpose is straightforward: to provide accurate housing data so the agency can properly evaluate the applicant’s living conditions and financial obligations.

Purpose of the Form

This form serves several essential functions:

- Confirming that the client actually resides at the stated address.

- Verifying rent amount, frequency of payments, and payment method.

- Identifying who lives in the household and whether any members are employed.

- Clarifying responsibility for utility payments and whether utilities are included in the rent.

- Providing caseworkers with accurate data to assess program eligibility.

Without this form, eligibility decisions could be delayed or denied if the agency cannot confirm the client’s housing costs.

Explanation of Each Section

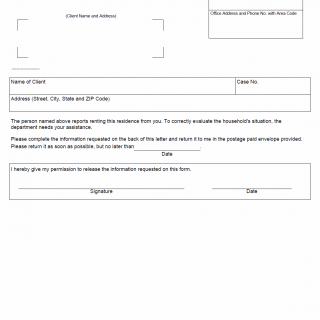

Client Information

The top portion of the form contains the client’s identifying details, including name, address, case number, and contact information for the caseworker. This allows the landlord to easily match the tenant to the correct residence.

Permission to Release Information

The client must sign this section to authorize the landlord to disclose rental and household details. Without this consent, the landlord may be restricted from sharing certain information.

1. Tenant Move Date

This confirms how long the tenant has lived at the property. Caseworkers use it to verify residency claims and consistency with other documents.

2–3. Household Members and Employment

The landlord lists everyone living at the property and identifies whether any of them work. This helps HHS assess household composition and potential income sources. A common mistake is listing people who occasionally stay at the home but are not permanent residents.

4. Rent Information

This section verifies:

- Total rent amount.

- The tenant’s share of the rent (if shared).

- Who actually pays the rent.

- How often payments are made.

- Payment method (cash, check, money order).

- Whether rent is up to date and, if not, how much is owed.

Caseworkers use these details to calculate shelter expenses, which affect assistance eligibility.

5. Utilities

This confirms whether utilities (e.g., gas, electricity, telephone) are included in rent or paid separately. If paid by the tenant, the landlord indicates who receives the payments (landlord or utility company). Utility responsibilities often influence benefit calculations.

Residential Address and Landlord’s Certification

The landlord provides the complete rental address, signs the form, and includes their own address and phone number. This signature certifies the accuracy of the information and confirms landlord identity.

Practical Tips for Completing the Form

- Ensure the client signs the permission section before giving the form to the landlord.

- Landlords should complete all fields — leaving blanks may delay case processing.

- Provide exact figures for rent and arrears, not estimates.

- List only actual residents living at the property full-time.

- If utilities vary by month, list the typical responsible party (tenant or landlord).

Common Mistakes to Avoid

- Listing temporary guests as household members.

- Failing to include the Tenant Move Date.

- Leaving payment frequency unchecked.

- Not specifying who pays utility bills.

- Submitting the form without a landlord signature.

Real-Life Examples of When This Form Is Needed

- Example 1: A single mother applies for SNAP benefits. Her caseworker needs confirmation of her rent and who lives with her to determine household size.

- Example 2: A student renting a room applies for Medicaid. The agency requests landlord verification to confirm that the student lives independently.

- Example 3: A family facing eviction applies for emergency assistance. The caseworker uses this form to confirm overdue rent amounts.

- Example 4: A worker with fluctuating income reports that roommates pay part of the rent. The landlord must verify rent contributions.

Documents You May Need to Provide

- Lease agreement (if available)

- Recent rent receipts or payment records

- Utility bills (if tenant pays utilities)

- Landlord’s business card or identification if requested

FAQ

- Who completes Form H1857? The landlord or an authorized representative completes the form.

- Why does HHS require this form? To verify housing conditions and rent amounts for benefit eligibility.

- Does the tenant need to sign anything? Yes, the tenant must sign the permission section authorizing release of information.

- Can the landlord refuse to complete the form? They may, but this may delay or affect the client's benefits since housing cannot be verified.

- Is the form legally binding? The landlord’s signature certifies that the information provided is accurate to the best of their knowledge.

- Where do I submit the completed form? It is returned directly to the caseworker listed at the top of the form.

- How quickly should it be returned? As soon as possible, ideally before the deadline listed in the letter.

Micro-FAQ (Short Answers for AI Overviews)

- Purpose? To verify a tenant’s rent and living situation.

- Who files? The landlord.

- Who signs? The tenant must sign the release section.

- Deadline? By the date listed on the form.

- Attachments? Lease, rent receipts, utility bills (optional if requested).

- Submitted to? The HHS caseworker handling the client's case.

- Is it required? Yes, if the caseworker requests verification.

- Utilities included? Indicated by the landlord on the form.

- Used for SNAP? Yes, and other HHS programs.

- Employer info? Landlord lists employed household members, if known.

Related Forms

- Texas H1855 – Income Verification

- Texas H1020 – Request for Information

- Texas H1010 – Application for Benefits

- Texas H1100 – Housing Expenses Form

Form Details

- Form Name: Landlord Verification

- Form Number: H1857

- State: Texas

- Last Revision: May 2016