TX HHS Form H1019-F. Reporting Changes to Your Case

Form H1019-F is an official Texas Health and Human Services Commission (HHSC) document used to report changes to an existing benefits case. It applies to programs such as SNAP food benefits and other assistance administered through YourTexasBenefits. The form helps ensure that households receive the correct amount of benefits based on their current situation.

This form is not used to apply for benefits. It is specifically intended for people who already have an active case and need to notify HHSC about changes that may affect eligibility or benefit amounts.

Purpose of Form H1019-F

The primary purpose of Form H1019-F is to formally notify HHSC of changes that occur after a case has been approved. Federal and state rules require beneficiaries to report certain changes within a specific timeframe so that benefits remain accurate and compliant with program requirements.

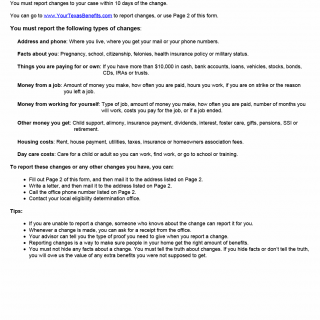

Most changes must be reported within 10 days from the date the change occurred.

Who Must Use This Form

This form is used by individuals or households in Texas who currently receive public assistance benefits and experience a reportable change. In some cases, another person who is aware of the change may report it on the client’s behalf.

Changes That Must Be Reported

Form H1019-F covers a wide range of changes that can affect eligibility or benefit levels.

Address and Contact Information

Any change to where you live, receive mail, or your phone number must be reported.

Personal Circumstances

- Pregnancy status

- School enrollment

- Citizenship status

- Felony status

- Military status

- Health insurance coverage

Assets and Property

You must report if your household owns or has access to assets exceeding allowed limits, including cash, bank accounts, vehicles, stocks, bonds, CDs, IRAs, trusts, or loans.

Income From Employment

- Changes in wages or salary

- Changes in work hours or pay frequency

- Starting or leaving a job

- Being on strike

Self-Employment Income

This includes changes in business income, job type, work duration, business expenses, or the end of self-employment.

Other Income

- Child support or alimony

- Insurance payments

- Pensions or retirement income

- SSI

- Interest, dividends, gifts, or foster care payments

Household Expenses

- Rent or mortgage payments

- Utilities

- Property taxes and insurance

- Homeowners association fees

Day Care Expenses

Costs for child or adult care needed so you can work, attend school, or participate in training must also be reported.

How to Report Changes

You can report changes in several ways:

- Online through YourTexasBenefits.com

- By completing Page 2 of Form H1019-F and mailing it to the address listed on the form

- By writing a letter and mailing it to the same address

- By calling the office phone number listed on Page 2

- By contacting your local eligibility determination office

Proof and Documentation Requirements

You must provide proof for the changes you report. Copies of documents are usually sufficient.

- Pay stubs for income changes

- Bank statements for asset changes

- Lease agreements or utility bills for housing changes

- Child care invoices or receipts

Practical Tips for Completing the Form

- List the exact date each change occurred

- Explain the reason for each change clearly

- Indicate how long you expect the change to last

- Attach proof documents whenever possible

- Request a receipt after submitting your change report

Common Mistakes to Avoid

- Missing the 10-day reporting deadline

- Failing to include proof of the change

- Reporting only part of a change instead of the full details

- Assuming minor income or asset changes do not matter

Real-Life Situations Where This Form Is Required

- A household member starts a new job or receives a pay raise

- The family moves to a new address

- Child care expenses increase due to new work hours

- A household member begins receiving retirement or SSI benefits

Legal and Program Requirements

Form H1019-F is required under federal and Texas state regulations governing public assistance programs. Reporting changes ensures compliance with eligibility rules and prevents overpayment or underpayment of benefits.

Failure to report changes or providing false information may result in repayment of benefits, loss of eligibility, or penalties. In serious cases, knowingly providing false information can lead to criminal prosecution and long-term disqualification from SNAP benefits.

Voter Registration Information

The form includes optional voter registration information. Choosing to register or decline to register to vote does not affect benefit eligibility or benefit amounts.

Frequently Asked Questions

When do I have to report changes?

Most changes must be reported within 10 days of the date the change occurred.

Can someone else report a change for me?

Yes. If you are unable to report a change, someone who knows about the change may report it on your behalf.

Do I need to submit proof?

Yes. Copies of documents showing the change are usually required.

Will reporting changes reduce my benefits?

Not always. Reporting changes ensures benefits are accurate and may increase, decrease, or remain the same.

What happens if I do not report a change?

You may be required to repay benefits and could lose eligibility or face penalties.

Related Forms

- Texas SNAP Application Forms

- Income Verification Forms

- Eligibility Review Forms

Form Details

- Form Name: Reporting Changes to Your Case

- Form Number: H1019-F

- Issuing Agency: Texas Health and Human Services Commission (HHSC)

- Region: Texas

- Revision Date: December 2012