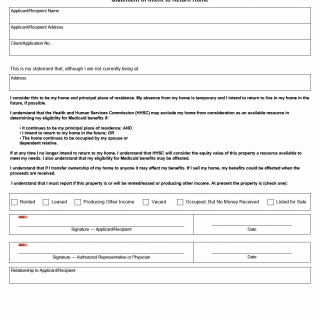

TX HHS Form H1245. Statement of Intent to Return to Home

The “Statement of Intent to Return Home” (Form H1245) is used in Texas Medicaid cases to clarify whether a person temporarily living away from their residence still considers that property their primary home. This form often becomes important when an applicant enters a hospital, nursing facility, rehabilitation center, or moves in temporarily with family members. Because Medicaid rules treat certain property as a “countable resource,” this statement helps the Health and Human Services Commission (HHSC) determine whether the home should be excluded from the resource calculation.

Although the form looks short, the decision it documents can significantly affect Medicaid eligibility—especially for long-term care applicants. Below is a detailed explanation designed to help you understand what each part means and how to complete it correctly.

Purpose of Form H1245

This form is used to formally declare that the applicant’s current absence from their primary residence is temporary and that they intend to return when possible. Under Medicaid policy, a home may be excluded from resources if:

- The applicant still considers it their main residence, and

- The applicant intends to return in the future, or

- The home is occupied by a spouse or dependent relative.

The form documents that intent, helping HHSC apply the correct policy.

Explanation of Key Sections

Applicant/Recipient Information

This section records the name, address, and client/application number of the person applying for Medicaid. HHSC uses this information to link the statement to the correct case file. A common mistake is listing a mailing address instead of the actual home address; the home address must match the property being declared as the principal residence.

Statement of Intent

This is the core of the form. The applicant confirms that:

- They are not currently living at the listed property.

- They still consider it their primary home.

- The absence is temporary.

- They intend to return in the future, if possible.

The phrase “if possible” is intentional. Medicaid rules recognize that someone in long-term care may not be able to predict their medical recovery or discharge date. What matters is maintaining the intent to return.

Explanation of HHSC Rules

This section clarifies the consequences of the applicant’s intent:

- If the applicant still considers the property their home, it can be excluded from countable resources.

- If the applicant stops intending to return, the equity value of the home may count toward resources.

- Transferring or selling the home could affect benefits.

- The applicant must report any rental or income-producing use of the property.

People often overlook the reporting requirement. Renting the property—even short-term—can change the home’s treatment under Medicaid rules.

Property Status (Check Boxes)

The applicant must select the current condition of the home. Choices include:

- Rented

- Leased

- Producing other income

- Vacant

- Occupied (but no money received)

- Listed for sale

HHSC uses this information to determine whether the property is still exempt. For example, a listed-for-sale home may or may not remain exempt depending on other circumstances.

Signatures and Relationship

The applicant (or their authorized representative) must date and sign the form. If someone signs on behalf of the applicant—such as a guardian, power of attorney holder, or family member—they must state their relationship. HHSC may request documentation supporting their authority to sign.

When You Must Submit This Form

- When applying for Medicaid and the applicant is temporarily living somewhere else.

- When the applicant has moved into a nursing facility but plans to return home if health improves.

- When HHSC requests clarification regarding ownership of the home.

- When the home is occupied by a spouse or dependent relative.

When This Form Is Not Required

- When the home is permanently vacated with no intent to return.

- When the property is not the applicant’s principal residence.

- When the applicant no longer owns the property.

Real-World Examples

- Short-term rehabilitation stay: A Medicaid applicant moves into a rehab facility after surgery. They expect to return home in a few months, so Form H1245 supports the home exclusion.

- Nursing facility admission: An elderly applicant enters long-term care but still intends to return home if their condition improves. The form documents this intent for HHSC.

- Hospitalization: A person hospitalized for an extended period may need this form if their home is temporarily unoccupied.

- Living with relatives temporarily: Someone stays with family while recovering from illness but still considers their home their principal residence.

Common Mistakes to Avoid

- Failing to provide the actual home address associated with the property.

- Not reporting when the home begins to produce rental income.

- Leaving the property status section unmarked.

- Signing the form without authority (when a representative signs).

- Not notifying HHSC if intent to return changes.

Required Documents

- Proof of home ownership (deed, tax statement, mortgage document).

- Verification of who currently occupies the home (if applicable).

- Power of attorney or guardianship papers if someone signs on behalf of the applicant.

- Any documents showing rental or sales activity, if the property generates income.

Practical Tips for Filling Out the Form

- Use the exact legal address of the home as it appears on county property records.

- If the applicant is unsure of their return date, simply indicate that the absence is temporary.

- Be consistent: the information must match what is stated on the Medicaid application.

- If the home is generating income, report it immediately—it can affect eligibility.

- Always keep a copy of the completed form for your records.

FAQ

- Does this form guarantee my home will be excluded from resources? No. HHSC considers several factors, including occupancy, ownership, and intent.

- Can a family member sign the form? Yes, if they are an authorized representative, guardian, or hold power of attorney.

- What if my health prevents me from returning home? HHSC evaluates ongoing intent; a change in intent must be reported.

- If I rent out my home, can it still be excluded? Possibly, but income must be reported and can affect eligibility.

- Do I need this form if my spouse still lives in the home? Often yes, because HHSC may request documentation of occupancy and intent.

- What happens if I sell the home? The proceeds may count toward resources and affect benefits.

Micro-FAQ

- Purpose? Declares intent to return home so HHSC can apply home exclusion rules.

- Who files? Medicaid applicants temporarily living away from their home.

- Deadline? Usually at application or when HHSC requests it.

- Attachments? Proof of ownership, occupancy, and representative authority.

- Submitted to? Texas Health and Human Services Commission.

- Required for nursing home applicants? Often yes.

- Accepted if signed by a representative? Yes, with proper authorization.

- Counts as legal proof? It documents intent but does not transfer property rights.

Related Forms

- Texas Medicaid Application Form H1200

- Form H1826 – Verification of Rent or Mortgage

- Form H0003 – Appointment of an Authorized Representative

- Medicare Savings Program forms

Form Details

- Form Name: Statement of Intent to Return Home

- Form Number: H1245

- State/Agency: Texas Health and Human Services Commission (HHSC)

- Original Issue: September 1997

- Purpose: Declaration of continued home residency intent for Medicaid eligibility