TX HHS Form H1202-A. MAO Worksheet-Income Changes

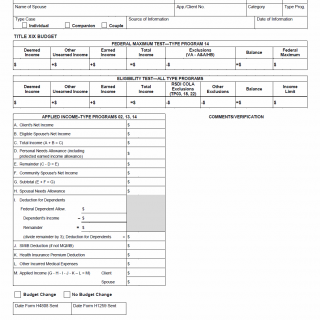

The TX HHS Form H1202-A, MAO Worksheet-Income Changes, helps individuals or couples who receive Medicaid benefits to report changes in their income. This form is used when there has been an increase or decrease in income that may affect the individual's or couple's eligibility for Medicaid benefits.

This worksheet requires information about the individual's or couple's earned and unearned income, as well as any exclusions or deductions that apply. The form also includes a calculation to determine the applied income, which is used to determine the client's budget change. The individual or couple filling out this form must provide details on their income changes and calculate their applied income according to the instructions provided.

Key features of this form include:

- Reporting income changes that may affect Medicaid eligibility

- Providing information about earned and unearned income, exclusions, and deductions

- Calculating applied income to determine budget change